Planned Gift Tracking Guide

020112

©2012 Blackbaud, Inc. This publication, or any part thereof, may not be reproduced

or

t

ransmitted in any form or by any means, electronic, or mechanical, including photocopy

ing,

recording

, storage in an information retrieval system, or otherwise, without the prior writ

ten

pe

rmission of Blackbaud, Inc.

The information in this manual has been carefully checked and is believed to be accurate.

Blackbaud, Inc., assumes no responsibility for any inaccuracies, errors, or omissions in this

manual. In no event will Blackbaud, Inc., be liable for direct, indirect, special, incidental, or

consequential damages resulting from any defect or omission in this manual, even if advised of

the possibility of damages.

In the interest of continuing product development, Blackbaud, Inc., reserves the right to make

improvements in this manual and the products it describes at any time, without notice or

obligation.

All Blackbaud product names appearing herein are trademarks or registered trademarks of

Blackbaud, Inc.

All other products and company names mentioned herein are trademarks of their respective

holder.

RE7-PlannedGiving-020112

Contents

W

HAT

I

S

I

N

T

HIS

G

UIDE

?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

III

P

LANNED

G

IFT

T

RACKING

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Frequently Used Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Navigate in Planned Giving . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Understand the Planned Gift Record . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Track Planned Gifts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

P

LANNED

G

IFTS

M

IGRATION

T

OOL

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Planned Gifts Migration Tool . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

I

NDEX

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

1chapter

What Is In This Guide?

In the Planned Gift Tracking Guide, you learn about planned giving vehicle types and how to add, edit, and delete

planned gift records (when you have the optional module PlannedGiftTracker). For further information about

PlannedGiftTracker, see the following.

• “Frequently Used Terms” on page 3

• “Understand the Planned Gift Record” on page 9

• “Track Planned Gifts” on page 25

How Do I Use These Guides?

The Raiser’s Edge user guides contain examples, scenarios, procedures, graphics, and conceptual information. To

find help quickly and easily, you can access the Raiser’s Edge documentation from several places.

User Guides. You can access PDF versions of the guides by selecting Help, User Guides from the shell menu bar

or by clicking Help on the Raiser’s Edge bar in the program. You can also access the guides on our Web site at

www.blackbaud.com. From the menu bar, select Support, User Guides.

In a PDF, page numbers in the Table of Contents, Index, and all cross-references are hyperlinks. For example,

click the page number by any heading or procedure on a Table of Contents page to go directly to that page.

Help File. In addition to user guides, you can learn about The Raiser’s Edge by accessing the help file in the

program. Select Help, The Raiser’s Edge Help Topics from the shell menu bar or press F1 on your keyboard

from anywhere in the program.

Narrow your search in the help file by enclosing your search in quotation marks on the Search tab. For

example, instead of entering Load Defaults, enter “Load Defaults”. The help file searches for the complete

phrase in quotes instead of individual words.

1chapter

Planned Gift Tracking

Frequently Used Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Navigate in Planned Giving . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Access a Planned Gift Record. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Understand the Planned Gift Record . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Gift Tab. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Miscellaneous Tab. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Planned Gift Tab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Vehicle: Bequest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Vehicle: Gift Annuity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Vehicle: Lead Annuity Trust or Remainder Annuity Trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Vehicle: Lead Unitrust or Remainder Unitrust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Vehicle: Pooled Income Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Vehicle: Retained Life Estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Vehicle: Other Planned Gift . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Vehicle: Life Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Soft Credit Tab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Automatically Apply Soft Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Matching Gifts Tab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Tribute Tab. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Attributes Tab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Realized Revenue Tab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Split Gift Tab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Track Planned Gifts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Add a Planned Gift . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Edit a Planned Gift. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Delete a Planned Gift . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

Procedures

Ope

n an existing planned gift from the Records page. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Add a planned gift for a bequest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Add a planned gift for a lead annuity trust. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Add a planned gift for a retained life estate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Create and link a new gift to a planned gift . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Link an existing gift record to a planned gift record . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Edit a planned gift record for a mature planned gift . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Delete a planned gift from the Gifts tab of a constituent record . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

2

C

HAPTER

P

LANNED

G

IFT

T

RACKING

3

With the optional module PlannedGiftTracker, you can create gift records for your organization’s planned giving,

including information specific to numerous types of planned gift vehicles. You can record both the initial gift value

and the gift’s remainder value, store basic payout information for applicable gift vehicles, and keep track of

multiple beneficiaries and relationships for a planned gift. In addition, when a planned gift consists of one or

more assets, such as stock or property, you can itemize the assets.

Because information concerning planned gifts can be very sensitive, PlannedGiftTracker includes security settings

so you can restrict access to this information based on security groups. Users without rights to

PlannedGiftTracker cannot enter or view gift information or generate reports for planned gifts. For more

information about the planned gifts security options, see the Configuration & Security Guide.

In addition, PlannedGiftTracker includes two reports, allowing authorized users to view and print gift information.

These reports incorporate a Columns tab that provides greater flexibility to select and organize the information

to appear. For more information about these reports, see the Reports Guide and Sample Reports Guide.

Frequently Used Terms

This section defines words and phrases you need to know as you work with planned giving. If you come across an

unfamiliar term when you read this or any chapter in The Raiser’s Edge documentation, check the online glossary

in the help file.

Bequest. A bequest planned gift is the most basic form of a planned gift. It includes a donor transfer of assets to a

recipient(s) upon a donor’s passing.

Discount Rate Percent. The IRS determines (and values each month) the discount rate percent. The discount rate

percent is an estimate of the annual rate of return on invested gift assets, used to help determine charitable

deductions applicable for some types of planned gifts.

Expected Maturity Year. Expected maturity year is the year in which it is estimated that all conditions for the

planned gift are met and the balance of the gift is allocated to the final recipient. This may be the year the last

beneficiary is estimated to pass away, it may be based on a fixed time period, or it may be stated by another

way the terms of the gift vehicle dictates. The Raiser’s Edge does not calculate the expected maturity year.

You enter the expected maturity year in the Expected maturity year field on the Gift tab of the planned gift

record.

Flexible Deferred. Flexible deferred planned gifts apply to gift annuities only. With a flexible deferred planned gift,

payments can be deferred for a period of time selected by the donor.

Gift Annuity. A gift annuity gives assets to an organization from a donor. In exchange, the organization agrees to

pay specified beneficiaries a fixed amount of money each year for life. The organization can pay the

beneficiary in installments. When the last beneficiary passes away, the remainder of the annuity belongs to

the organization.

Gift has been realized. Once all scheduled payments from the planned gift are made and the final balance of the

gift is allocated to the final recipient(s), mark Gift has been realized on the Gift tab of the Planned Gift record.

When you mark this checkbox, you indicate the gift has fully matured. In Reports, you can filter planned giving

reports based on the Gift has been realized checkbox. For more information about planned giving reports,

see the Reports Guide and the Sample Reports Guide.

Lead Annuity Trust. A lead annuity trust is similar to a remainder annuity trust. The exception is that a lead

annuity trust’s payments are made to the organization instead of the beneficiaries. When the trust term ends,

the remainder of the assets are returned to the donor, rather than the organization.

Note: You may have previously added planned gifts in The Raiser’s Edge as Other gift records using Gift

attributes, Gift subtypes, or Gift codes. If so, you can use the Planned Gifts Migration Tool to migrate these

gifts to records with a gift type of Planned Gift. For more information about this tool, see Appendix A in this

guide.

4

C

HAPTER

Lead Unitrust. Identical to a lead annuity trust, except the lead unitrust payments to the organization are based

on a fixed percentage of the trust’s value (to be valued again annually), rather than a fixed amount of money

for each payment.

Life Insurance. A constituent may have a life insurance policy that no longer fits the needs of his family and may

decide to donate the life insurance policy to your organization. Add a gift of life insurance as a planned gift

with a vehicle of Life Insurance.

Pooled Income Fund. The organization establishes the Pooled Income Funds (PIF). With a PIF, gifts from several

donors are pooled into a fund (not a Raiser’s Edge fund). A donor specifies the PIF to which his gift is invested

and is assigned a number of units. Units are based on the proportion of that fund’s total amount that the gift

represents. On a quarterly schedule, investment earnings from the fund are paid, proportionally based on the

number of units, to the designated beneficiaries of each of the fund’s contributors. When the last designated

beneficiary for each donor’s gift passes away, that donor’s proportional share of the current total is removed

from the fund and distributed to the organization.

Remainder Annuity Trust. A remainder annuity trust is similar to a gift annuity, except the assets are set up in a

trust. A third party trustee (in some circumstances, your organization) invests and manages the trust. The

term of the trust may be defined as a specific period of years or may last the lifetimes of the beneficiaries.

When the trust term ends, the remainder of the assets goes to the organization.

Remainder Unitrust. Identical to a remainder annuity trust, except the remainder unitrust payments to the

beneficiaries are based on a fixed percentage of the trust’s value (to be valued again annually), rather than a

fixed amount of money for each payment.

Retained Life Estate. Through a retained life estate, a donor gives a home to an organization but retains the right

to use the house for a specified period of years or for life. The donor may specify a beneficiary who may use

the house after the donor’s death. When the specified period ends, the home goes to the organization.

Vehicle. The gift vehicle is the specific type of a planned gift that defines how the gift conditions are structured.

These are based on generally accepted legal instruments for transferring a planned gift to an organization. Gift

vehicles are constantly changing as applicable tax laws are amended and attorneys and financial planners

devise new vehicles. The Vehicle field is located on the Gift tab of a gift record.

P

LANNED

G

IFT

T

RACKING

5

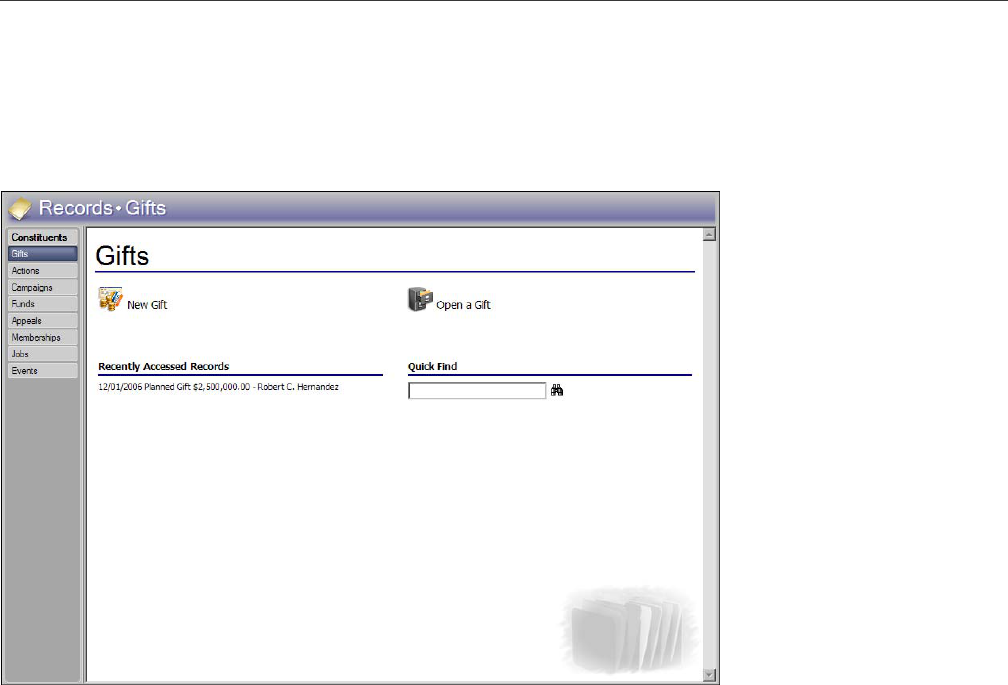

Navigate in Planned Giving

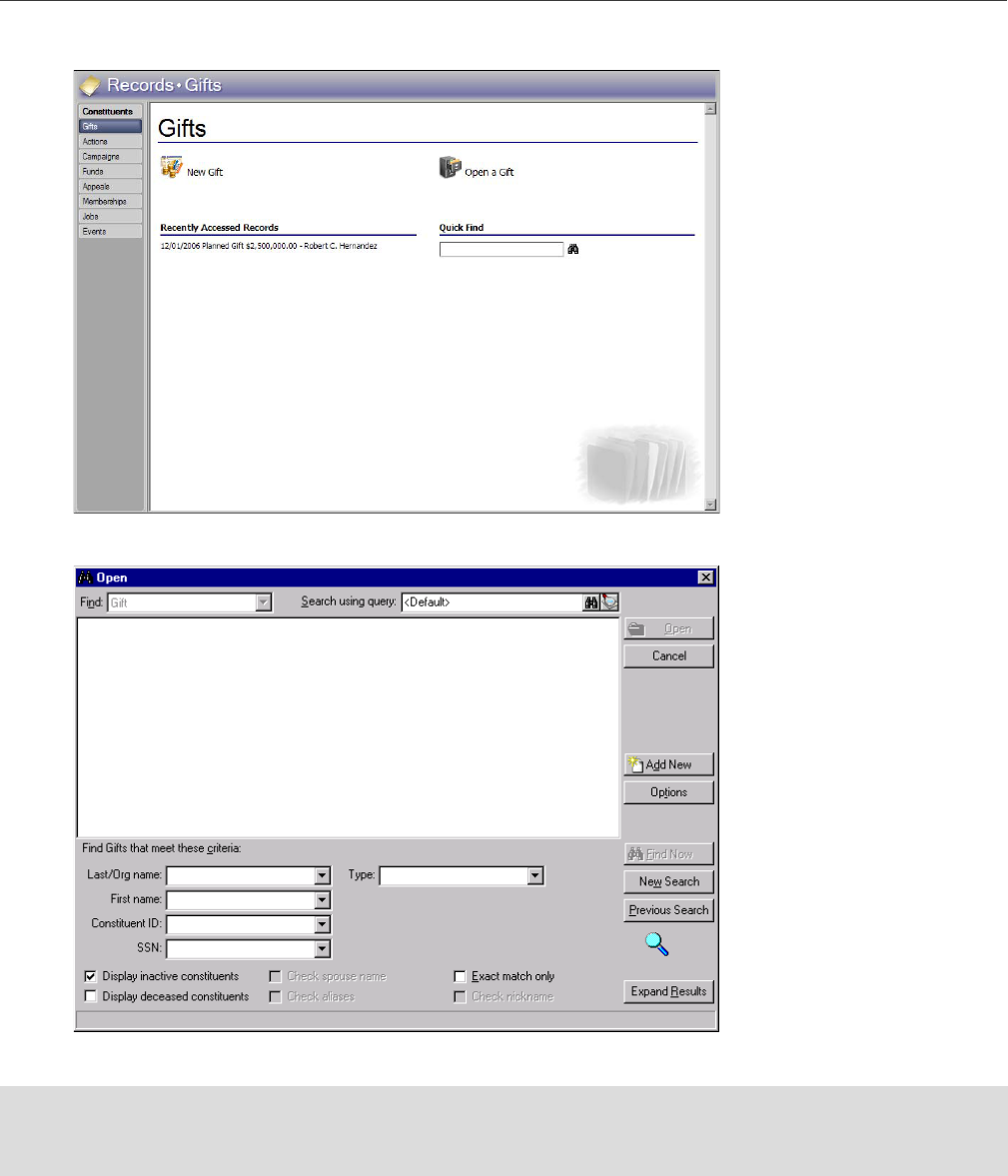

From the Gifts page, you can create a new gift record for the gift type of Planned Gift. You can also open existing

gift records from this page. To access the Gifts page, click Records on the Raiser’s Edge bar, then click the Gifts

link.

The Gifts page also contains a list of recently accessed records. To open any gift record in this list, click the gift

description. To quickly find a gift donated by a constituent, enter the constituent name in the Quick Find field and

click the binoculars to display a list of all gifts donated by the constituent.

Access a Planned Gift Record

After you create a planned gift, you can open the planned gift record from the Gifts tab of the constituent record.

You can also open an existing planned gift record from the Records page. This section explains how to open a

planned gift from the Records page. For more information about opening gifts displayed on the Gifts tab of a

constituent record, see “Edit a planned gift record for a mature planned gift” on page 43.

Open an existing planned gift from the Records page

1. On the Raiser’s Edge bar, click Records.

6

C

HAPTER

2. Click the Gifts link. The Gifts page appears.

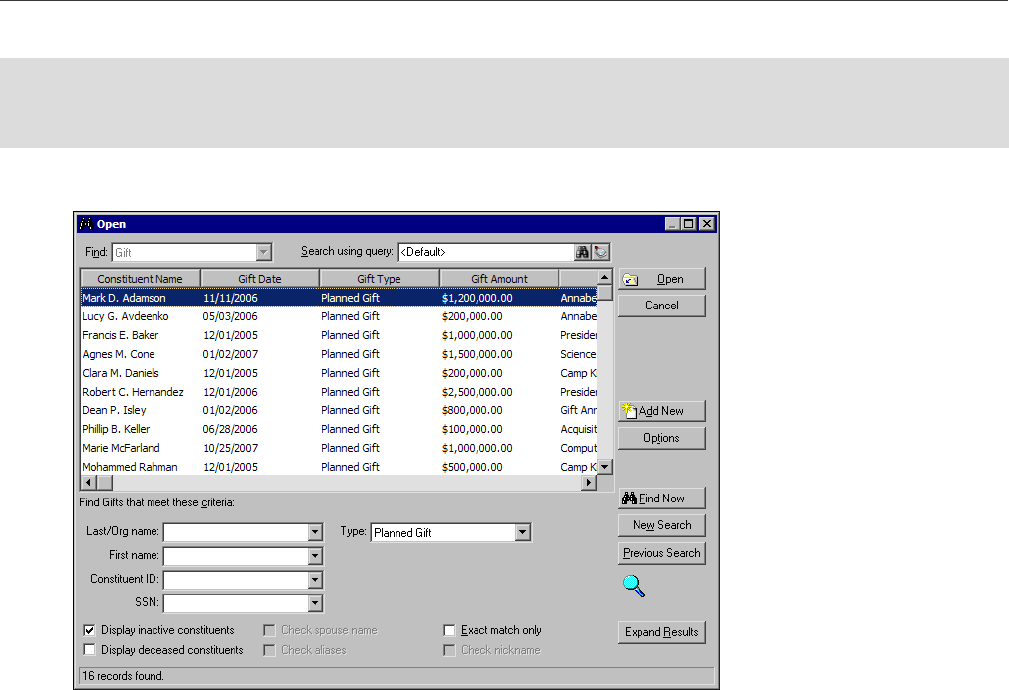

3. Click Open a Gift. The Open screen appears so you can search for the gift record to open.

4. In the Type field, select “Planned Gift.”

5. In the Find Gifts that meet these criteria frame, enter the other criteria to use to search for the planned

gift. You can search by an individual’s first or last name, organization name, constituent ID, and Social

Security Number.

Note: If you do not know the correct spelling or number, you can enter the first few letters or characters in the

criteria fields in Find Gifts that meet these criteria frame. For detailed information about how to use these

fields, see the Program Basics Guide.

P

LANNED

G

IFT

T

RACKING

7

6. Click Find Now. If the search criteria entered matches a gift in the database, the gift appears in the grid. If

the criteria entered matches multiple gifts, multiple gifts may appear.

7. In the grid, select the gift record to open.

All the fields, checkboxes, and buttons on the Open screen are discussed in detail in the Program Basics

Guide.

Warning: We recommend you search by one or two of the most helpful criteria types because the results that

appear in the grid must match all the criteria you enter. Too much criteria information in the Find Gifts that

meet these criteria frame can actually prevent you from finding a gift.

8

C

HAPTER

8. Click Open. The gift record appears.

9. After you enter or edit the appropriate information, click Save and Close on the toolbar.

P

LANNED

G

IFT

T

RACKING

9

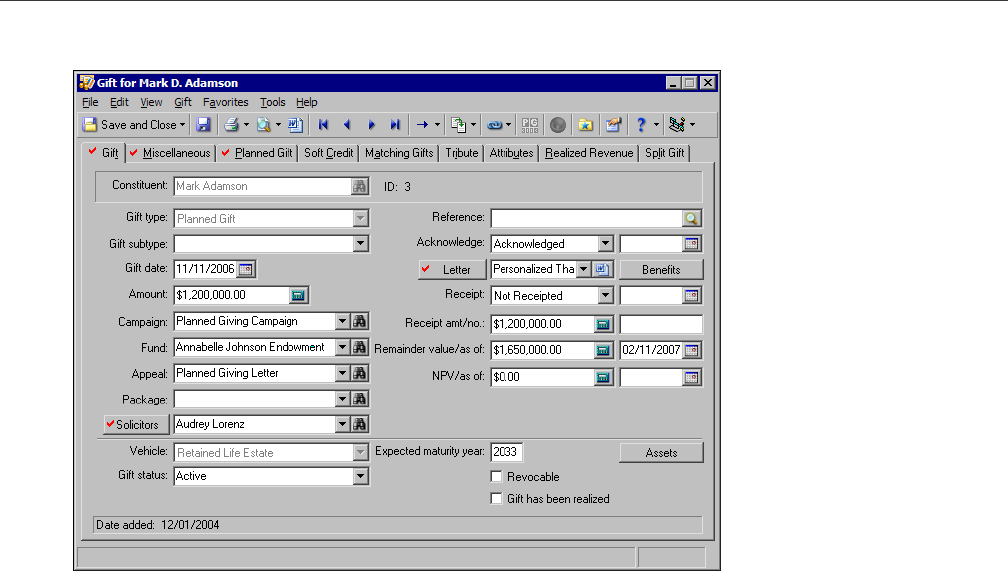

Understand the Planned Gift Record

When you add a planned gift, you create a gift record with the gift type of Planned Gift. To add a planned gift,

select “Planned Gift” in the Gift type field on the Gift tab. The New Gift screen appears with planned gift fields.

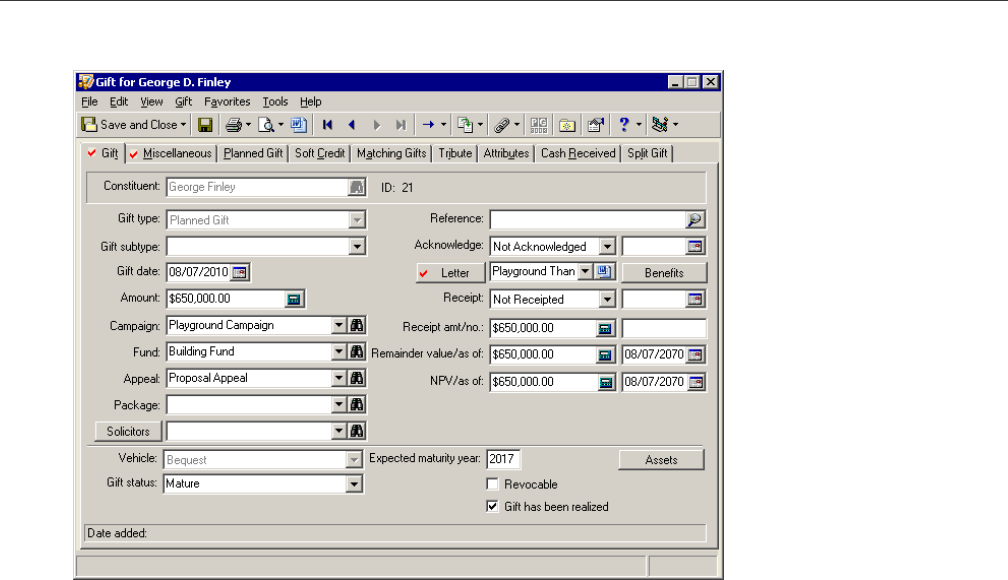

Gift Tab

Basic gift data entry applies to the majority of the Gift tab. For more information about gift data entry, see the

Gift Records Guide. The Remainder value/as of and NPV/as of fields are specific planned giving data entry fields.

Additionally, the bottom section of the Gift tab contains planned giving data.

Note: The Raiser’s Edge does not calculate the estimated remainder value or NPV amounts. We recommend

you calculate these amounts in a third party software and enter them on the planned gift record.

10

C

HAPTER

We recommend the amount in the Remainder value field reflect the expected income amount for your

organization once all the conditions for a planned gift are met. In the as of date field, enter the last date the

remainder value amount was updated.

If your organization prefers to track the net present value of the planned gift (what the gift is worth “today” when

it matures), enter the value in the NPV field. In the as of date field, enter the last date the net present value was

updated.

In the Vehicle field, select a planned gift vehicle. The planned gift vehicle options are Bequest, Gift Annuity,

Remainder Annuity Trust, Lead Annuity Trust, Remainder Unitrust, Lead Unitrust, Pooled Income Fund, Retained

Life Estate, Other Planned Gift, and Life Insurance. On the Gift tab, in addition to the planned gift vehicle, you can

also track the planned gift status, the expected maturity year, assets, and whether the planned gift is revocable or

has been realized.

To acknowledge your donor for a planned gift, you can print the gift vehicle information from the planned gift

record in a Donor Acknowledgement Letter or Honor/Memorial Acknowledgement Letter (when you have the

optional module Honor/Memorial Tracking). For more information about how to process the Donor

Acknowledgement Letter or Honor/Memorial Acknowledgement Letter mail task, see the Mail Guide.

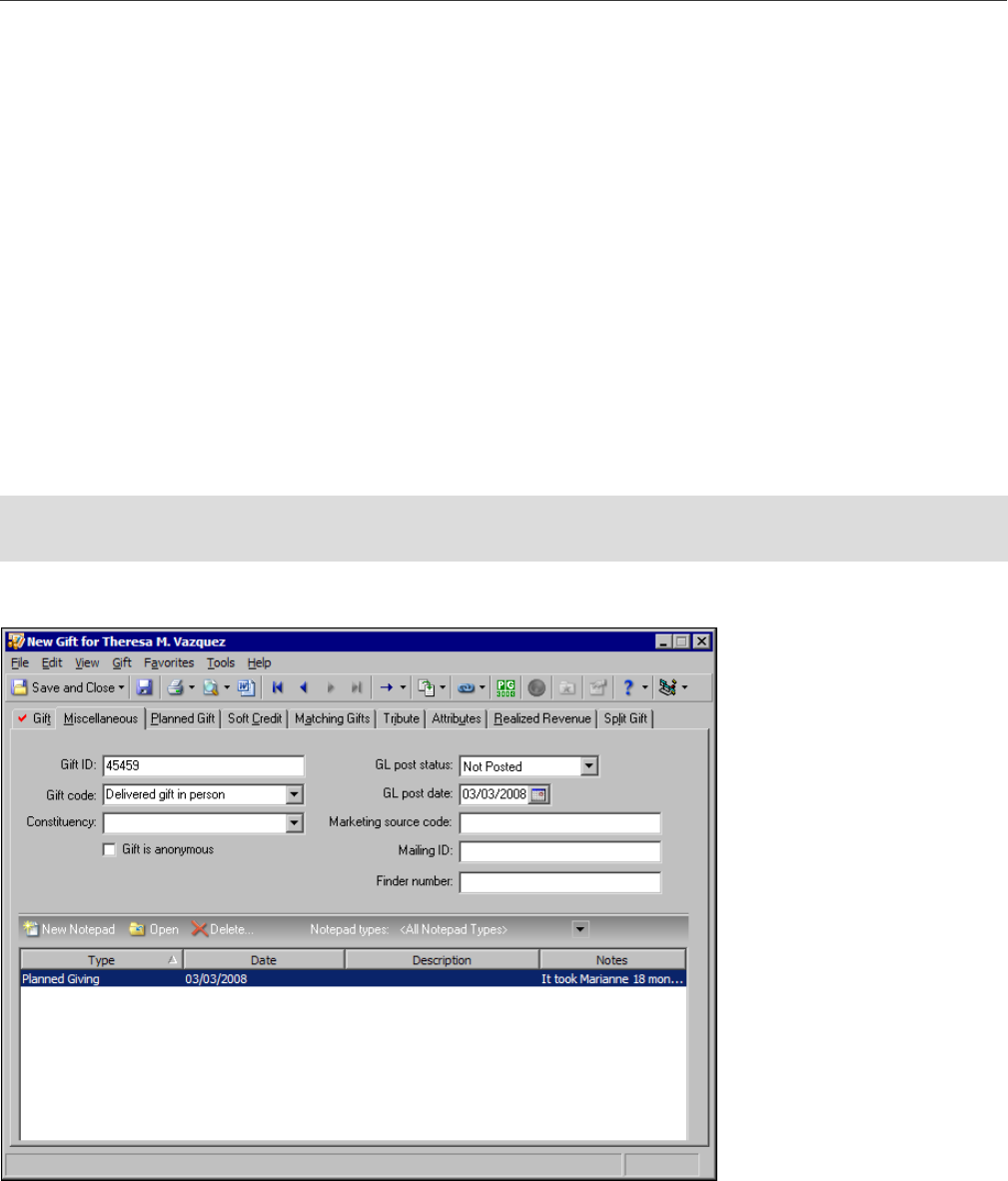

Miscellaneous Tab

On the Miscellaneous tab, you can record information such as gift ID, constituent code, and gift code for the

planned gift. You can also record any notes or direct marketing information required for your planned gift.

Warning: The Raiser’s Edge does not currently support posting planned gift records to The Financial Edge or

any other accounting software.

P

LANNED

G

IFT

T

RACKING

11

Planned Gift Tab

The options and fields that appear on the Planned Gift tab depend on the planned gift vehicle selected in the

Vehicle field on the Gift tab. For example, the Planned Gift tab for a Bequest gift vehicle tracks planned gift

relationship information for bequests only. The Planned Gift tab for a Gift Annuity gift vehicle tracks information

such as payment frequency, beneficiaries, and planned gift relationship information for gift annuities. The

options and fields that appear on the Planned Gift tab apply to the nature of each planned gift vehicle.

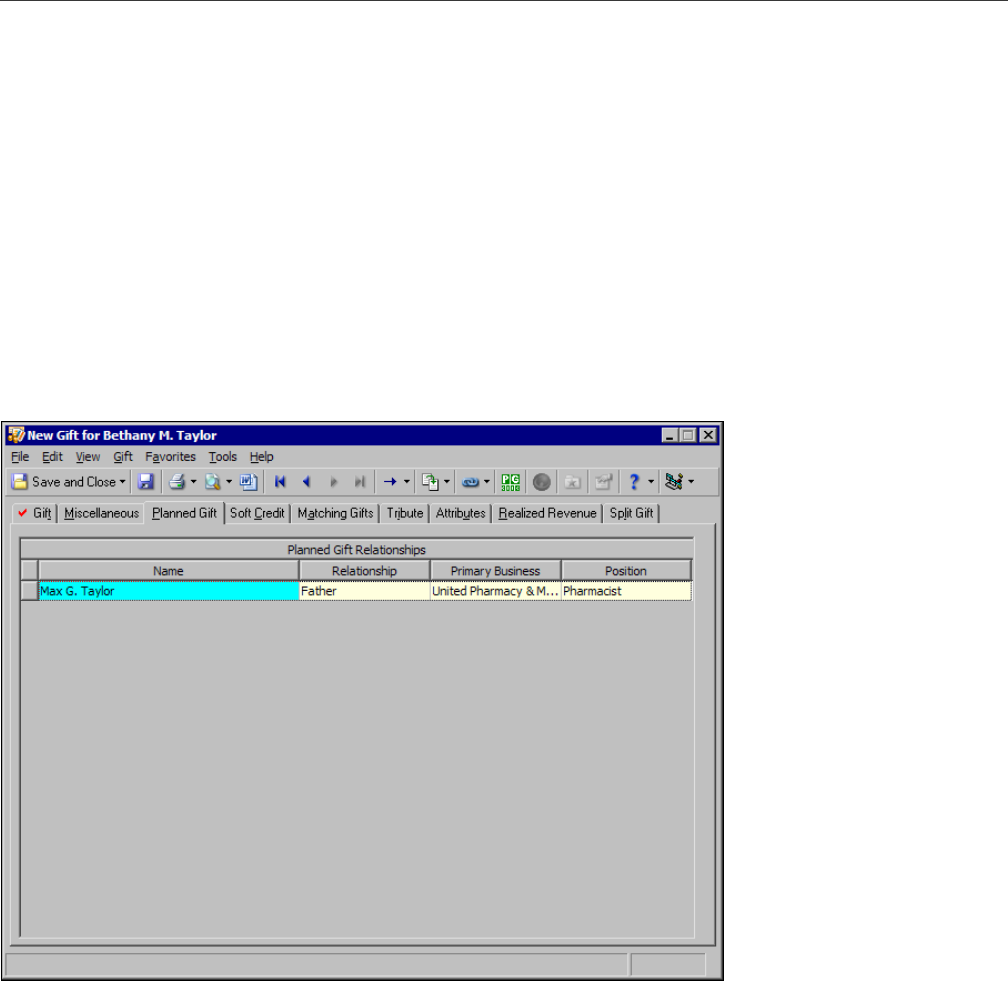

Vehicle: Bequest

A bequest is the most basic form of a planned gift. After the death of a donor, assets transfer to the recipient at

the donor’s request. Other than the recipient organization, beneficiaries do not exist for a bequest.

Therefore, the Planned Gift tab on a bequest planned gift record tracks only planned gift relationships. You can

use this tab to track the relationships to the gift, such as financial advisors, attorneys, or insurance agents. You

can also delete unwanted planned giving relationships on this tab.

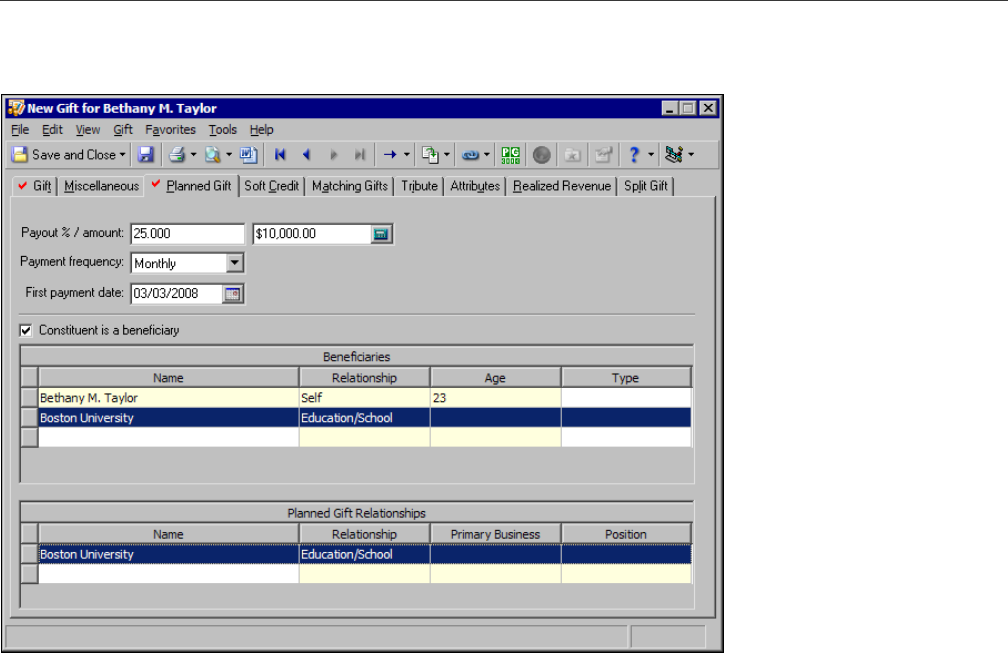

Vehicle: Gift Annuity

With a gift annuity, a donor gives specified assets to an organization. In exchange, the organization agrees to pay

specified beneficiaries a fixed amount of money each year for life. You can schedule payments to the beneficiary

in regular installments. When the last beneficiary passes away, the remainder of the annuity belongs to the

organization.

12

C

HAPTER

The Planned Gift tab for a gift annuity tracks the payout percent and amount, the payment frequency, whether

the gift annuity is flexible deferred, the starting payment date, the discount rate percent, the beneficiaries, and

the planned gift relationships.

Vehicle: Lead Annuity Trust or Remainder Annuity Trust

A lead annunity trust pays installments to an organization, rather than beneficiaries, at the donor’s request.

When the trust term ends, the remainder of the assets return to the donor rather than the organization.

A remainder annuity trust places assets in a trust, which a third party trustee invests and manages. The term of

the trust can last a specific period of years or for the lifetimes of the beneficiaries. When the trust term ends, the

remainder of the assets goes to the organization.

P

LANNED

G

IFT

T

RACKING

13

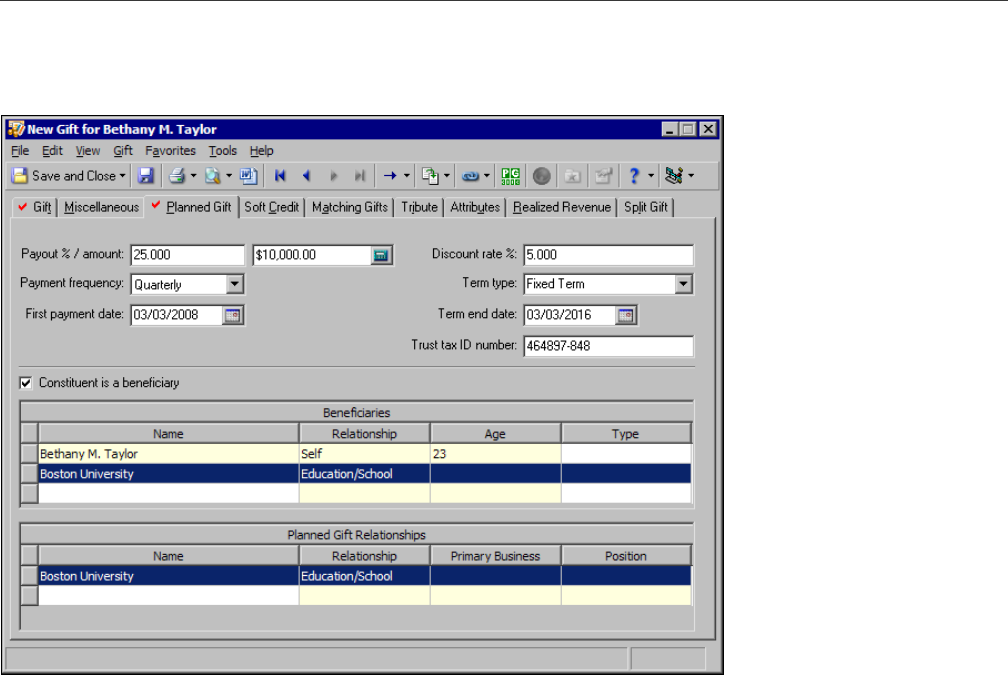

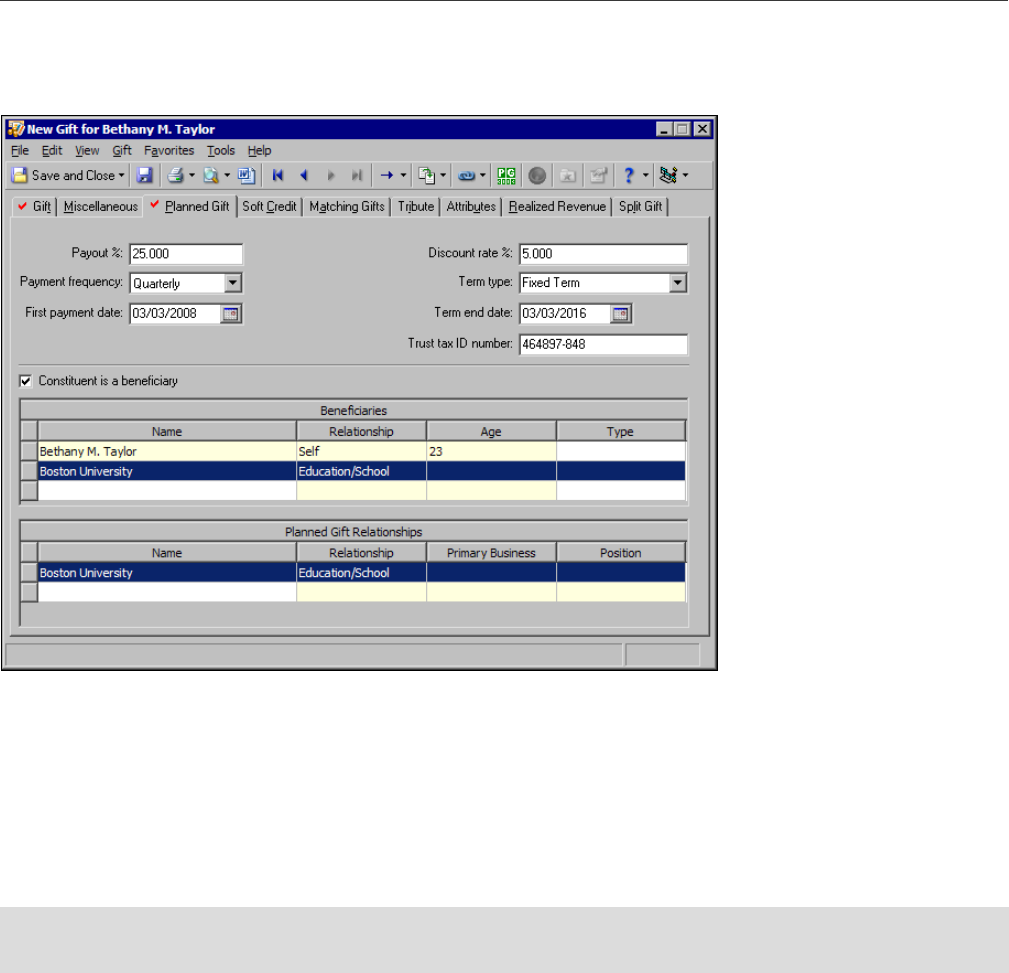

The Planned Gift tab for a lead annuity trust and a remainder annuity trust is the same. For these vehicles, the

Planned Gift tab tracks the payout percent, amount, payment frequency, first payment date, discount rate

percent, term type, term end date, trust tax ID number, beneficiaries, and planned gift relationship information.

Vehicle: Lead Unitrust or Remainder Unitrust

A lead unitrust planned gift is identical to a lead annuity trust, except payments to the organization are based on

a fixed percentage of the trust’s value, rather than a fixed amount of money for each payment.

A remainder unitrust planned gift is identical to a remainder annuity trust, except payments to the beneficiaries

are based on a fixed percentage of the trust’s value, rather than a fixed amount of money for each payment.

14

C

HAPTER

The Planned Gift tab for a lead unitrust and a remainder unitrust is the same. The Planned Gift tab tracks the

payout percent, payment frequency, first payment date, discount rate percent, term type, term end date, trust

tax ID number, beneficiaries, and planned gift relationship information.

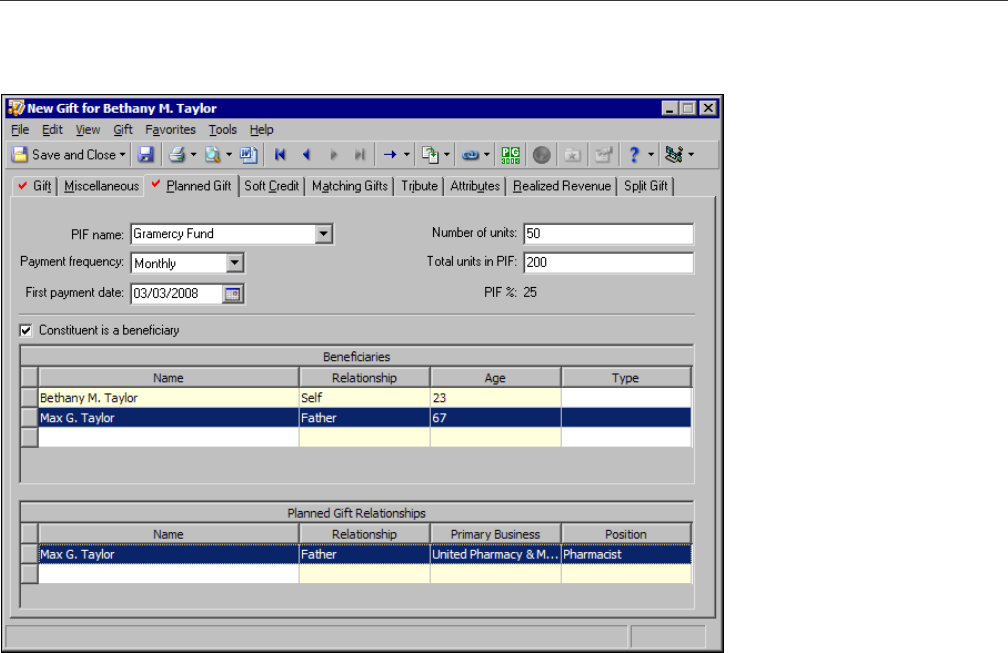

Vehicle: Pooled Income Fund

The organization establishes Pooled Income Funds (PIFs). PIFs consist of gifts from several donors pooled into a

fund (not a Raiser’s Edge fund). The donor selects the PIF in which to invest his gift. The donor is then assigned a

number of units based on the proportion of the fund’s total amount their gift represents. On a quarterly

schedule, investment earnings from the fund are paid, based on the number of units, to the designated

beneficiaries. When the last beneficiary for each donor’s gift dies, the donor’s share of the current overall fund

total is removed from the fund and donated to the organization.

Note: The amount in the PIF% field is calculated automatically. This amount is the value entered in the

Number of units field divided by the value entered in the Total units in PIF field.

P

LANNED

G

IFT

T

RACKING

15

The Planned Gift tab for a PIF tracks the name of the PIF, payment frequency, first payment date, number of

units, total number of units, beneficiaries, and planned gift relationship information.

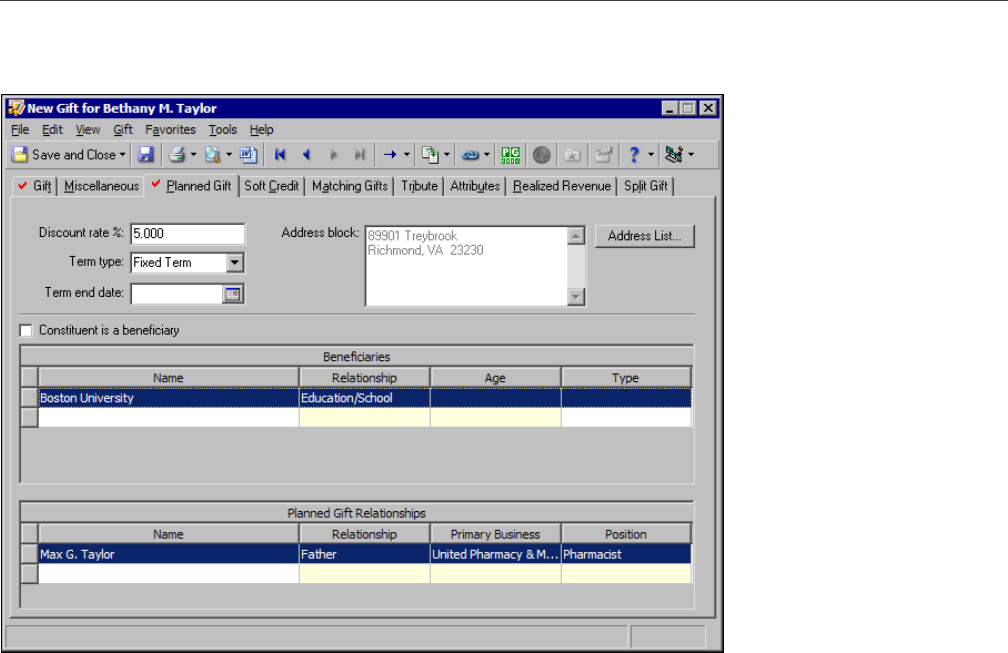

Vehicle: Retained Life Estate

Through a retained life estate, a donor gives a home to an organization but can live in or use the house for a

specified period of years or for life. The donor can also specify a beneficiary who may use the house after the

death of the donor. When the specified period ends or the last beneficiary dies, the home goes to the

organization.

16

C

HAPTER

The Planned Gift tab for a retained life estate tracks the discount rate percent, term type, term end date, address

of the house, beneficiaries, and planned gift relationship information.

Vehicle: Other Planned Gift

Your organization may receive a planned gift that is not one of the available planned gift record vehicle types,

such as a bargain sale (the sale of a property for an amount that is significantly lower than fair market value).

When this happens, select “Other Planned Gift” for the planned gift vehicle type.

P

LANNED

G

IFT

T

RACKING

17

The Planned Gift tab for Other Planned Gifts tracks the payout percent and amount, payment frequency, first

payment date, beneficiaries, and planned gift relationship information.

18

C

HAPTER

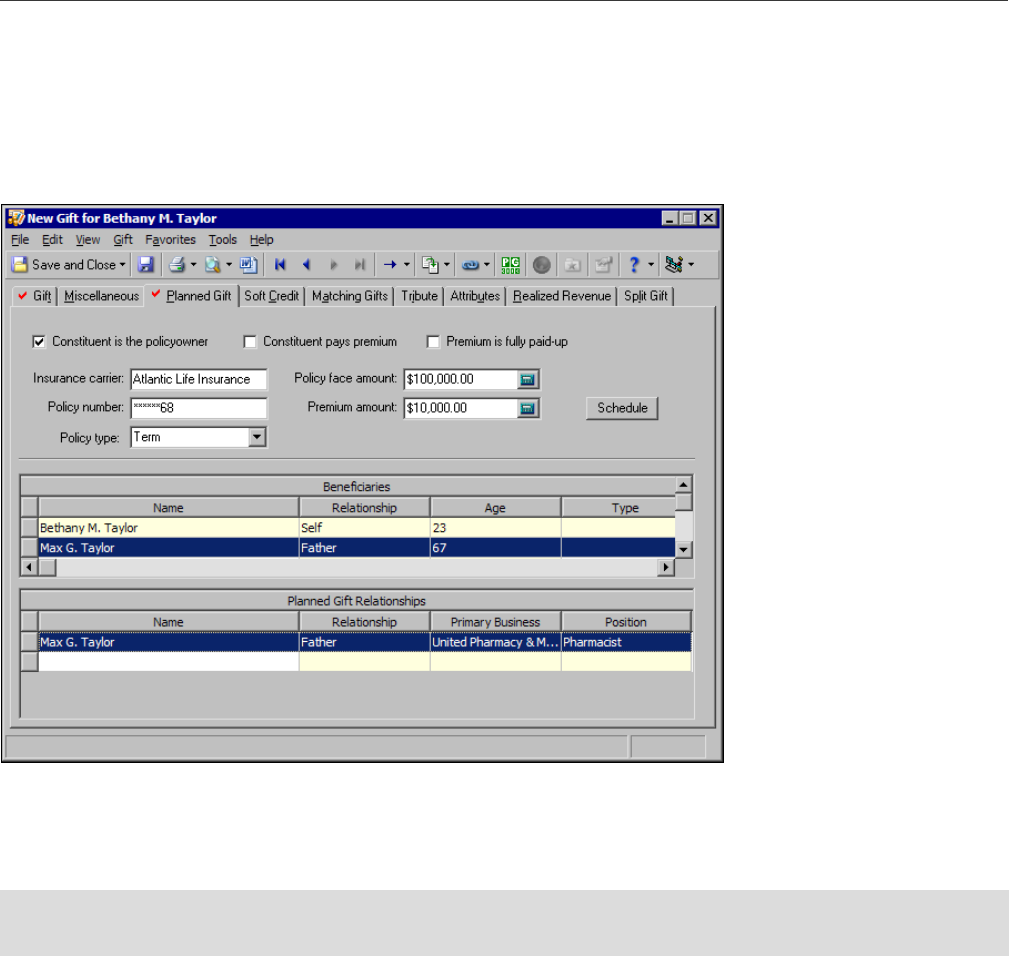

Vehicle: Life Insurance

Your organization may receive a gift of life insurance from a constituent. The Planned Gift tab for life insurance

tracks important life insurance information such as insurance carrier, premium amount, policy number, type, and

face amount. You can also track whether the constituent is the policy owner and pays the premium. If your

organization pays the premium, you can establish its payment schedule. In addition, you can track beneficiary

and planned gift relationship information on this tab.

If the constituent is the policy owner, mark Constituent is the policyowner. If your organization does not pay the

premium and the constituent is responsible for paying, mark Constituent pays premium. If the premium is paid

for, mark Premium is fully paid-up. If Constituent pays premium or Premium is fully paid-up is marked, the

Schedule button, used to schedule the premium installments, is disabled.

Note: If the constituent has paid the premium, mark Premium is fully paid-up. If your organization pays the

premium, mark this checkbox when the premium has been paid.

P

LANNED

G

IFT

T

RACKING

19

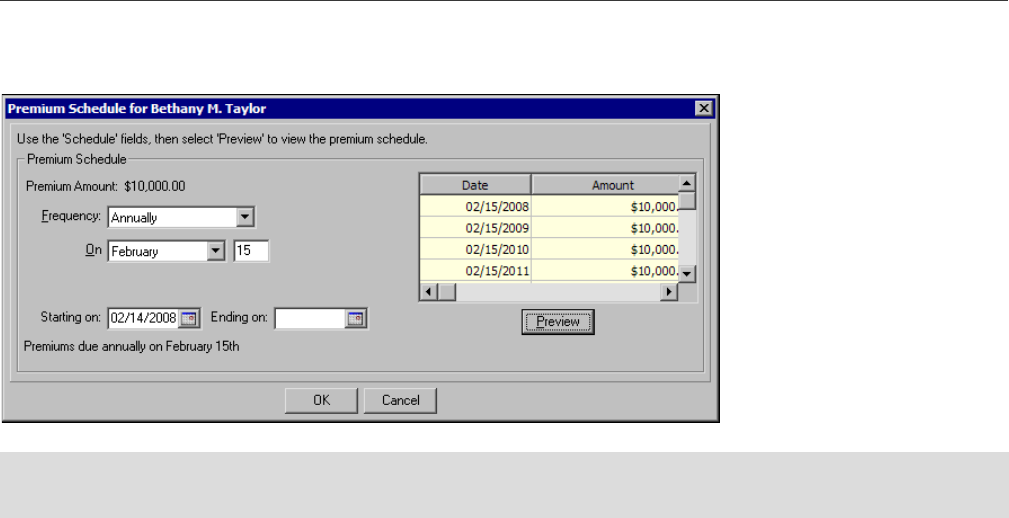

If your organization pays the premium, you can establish the installment schedule for premium payments. To do

this, click Schedule. The Premium Schedule screen appears.

On the Premium Schedule screen, you create a premium installment schedule. You select the frequency,

payment date, and duration of the premium installments. To automatically generate the premium installment

schedule, click Preview. To save your changes, click OK.

The remaining fields on the Planned Gift tab for a life insurance planned gift are data entry fields for tracking

purposes. Use these fields to store details about the life insurance policy such as the insurance carrier and policy

information. For security purposes, the life insurance policy number is masked and encrypted in the database. If

you see asterisks in this field, you do not have rights to view the data. For more information, consult your System

Administrator.

Soft Credit Tab

A soft credit allows multiple constituents to share credit for a single gift. When you soft credit constituents for a

gift, you can decide whether to split the credit evenly between all soft credit recipients, give each recipient full

credit for the gift, or define your own credit distribution.

Note: The Premium Schedule screen is for reference purposes for premium payment dates. The Raiser’s Edge

does not generate payment reminders or reconcile payments.

20

C

HAPTER

You can soft credit as many constituents as necessary, as long as each soft credit recipient is a constituent in the

database. When you create reports and mailings, you can determine whether the donor, the soft credit recipient,

or both receive credit for the gift in the mailing or report. The soft credit distribution you select for the report or

mailing does not affect the information entered on the Soft Credit tab of the planned gift record.

To soft credit a constituent for a planned gift, use the same procedure as for a regular planned gift record. For

more information, see “Track Planned Gifts” on page 25.

Automatically Apply Soft Credits

In Configuration, you can set a business rule to automatically copy soft credits from the Soft Credit tab of a gift

record to the Soft Credit tab of the matching gift pledge record when you save the gift record. For example, if

Frederick Thompson receives a soft credit for the full amount of the matched gift on Michael Simpson’s record,

the program can automatically add Frederick to the Soft Credit tab of the matching gift pledge when you save the

matched gift. After Frederick’s name appears on the Soft Credit tab of the matching gift record, you can change

the soft credit distribution as necessary. For more information about setting business rules, see the Configuration

& Security Guide.

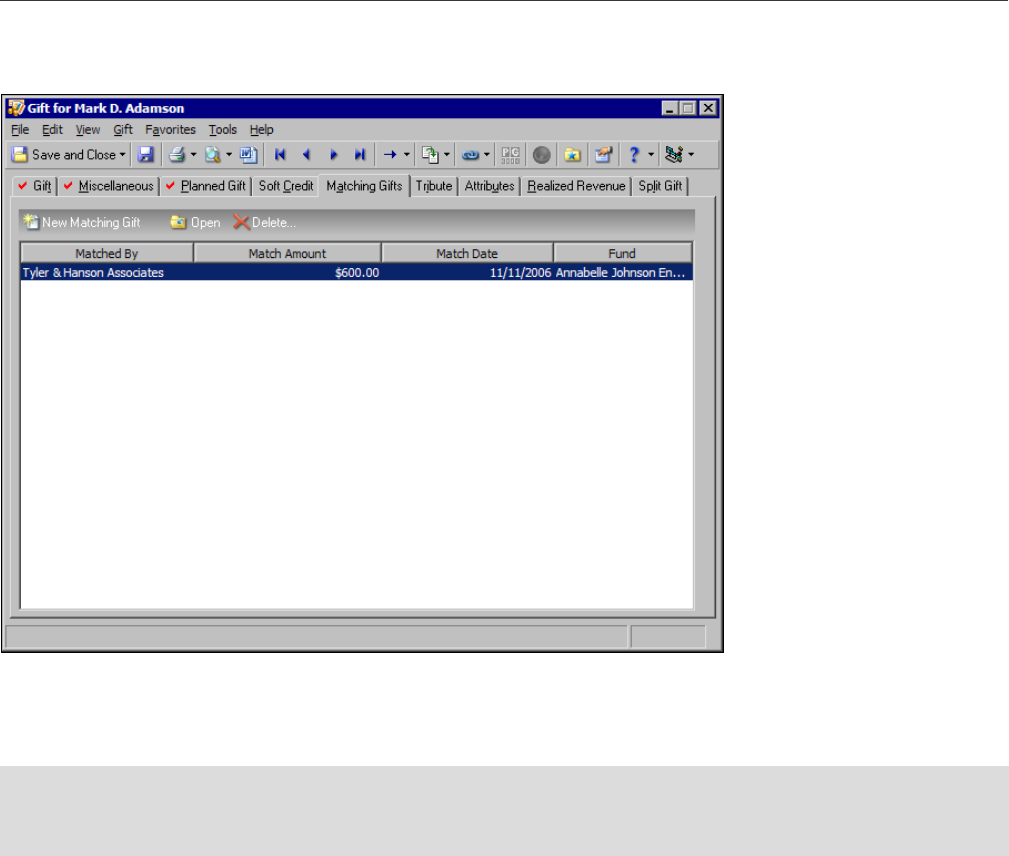

Matching Gifts Tab

Sometimes, companies match gifts donated to nonprofit organizations by their employees or corporate partners.

For example, Winston Tate, a Toy World employee, donates a recurring gift of $10 to your organization directly

from his paycheck as a part of Toy World’s payroll giving program. As part of the payroll giving program, Toy

World matches employee gifts on a one-to-one ratio when gifts meet certain criteria. Because Toy World

matches gifts donated by their employees, you receive an additional $10 gift from Toy World if Winston Tate’s

gift meets the criteria set by Toy World.

P

LANNED

G

IFT

T

RACKING

21

The majority of matching gift companies do not match planned gifts. However, the Matching Gift tab remains

available for a planned gift record.

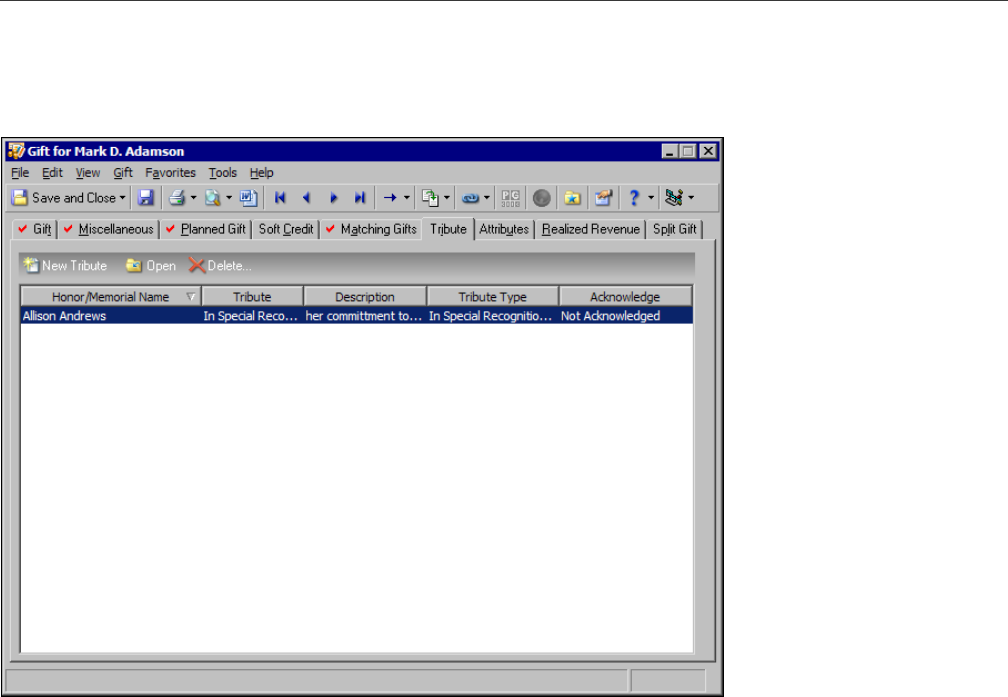

Tribute Tab

Warning: Before you begin to add tribute gifts, you must set up the tribute on the Honor/Memorial tab of the

honoree’s constituent record. For information about how to create a new tribute, see the Tribute Data Entry

Guide.

22

C

HAPTER

With the optional module Honor/Memorial Tracking, you can track detailed information about donations given in

honor, memory, or celebration of an individual or organization. With Honor/Memorial Tracking, you can use the

Tribute tab on a planned gift record to apply a gift to a tribute. A tribute explains the reason gifts are being

donated to your organization on behalf of an honor/memorial constituent.

P

LANNED

G

IFT

T

RACKING

23

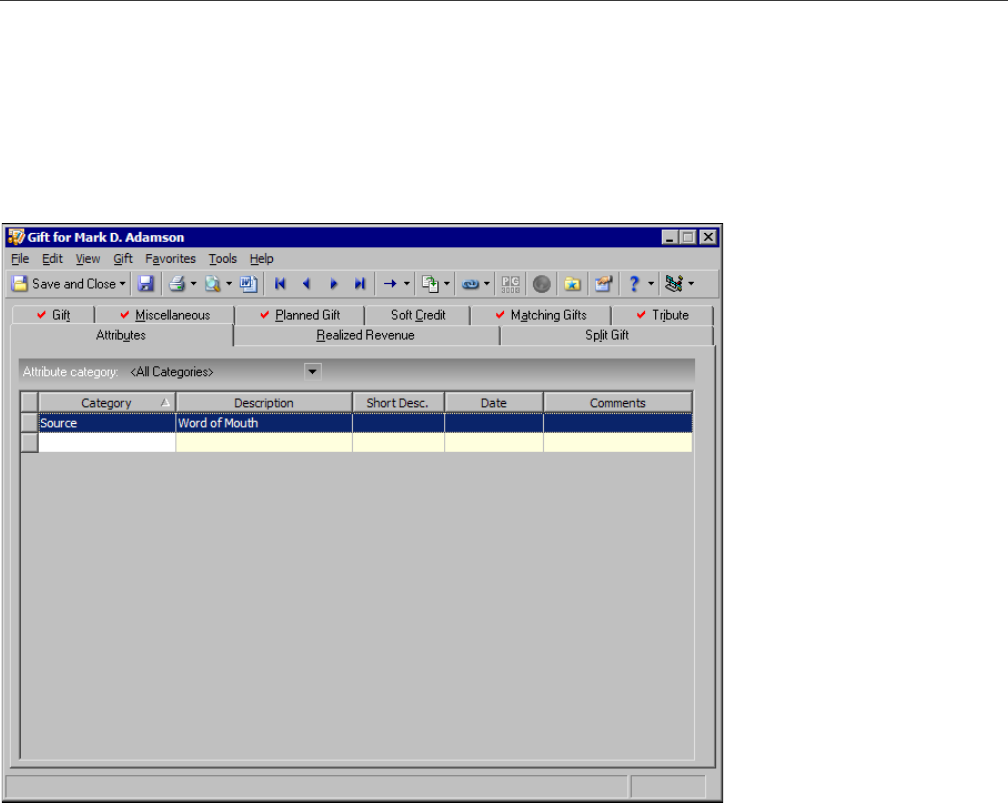

Attributes Tab

Throughout The Raiser’s Edge, you can add attributes to track information specific to your organization. On a

planned gift record, you can use the Attributes tab to store additional information about a planned gift. For

example, you can add a “Source - Word of Mouth” attribute to note how a planned gift donor originally heard of

planned giving for your organization. Later, you can create a query to locate all planned gift records with a certain

attribute type to help analyze your planned gift records.

24

C

HAPTER

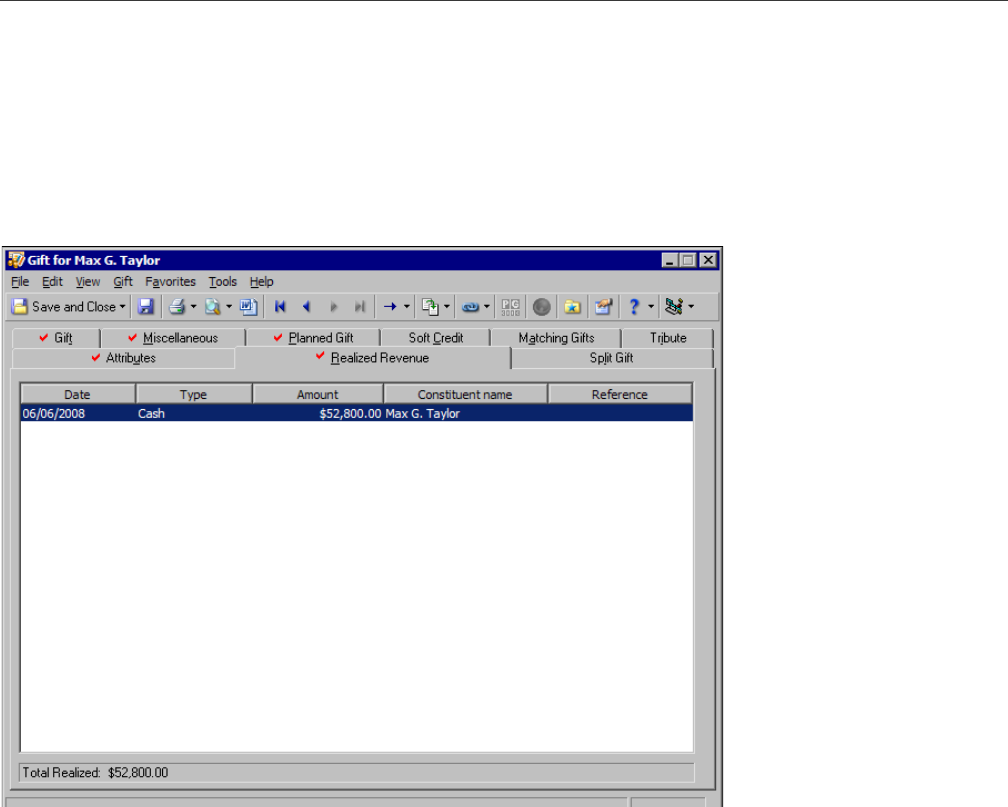

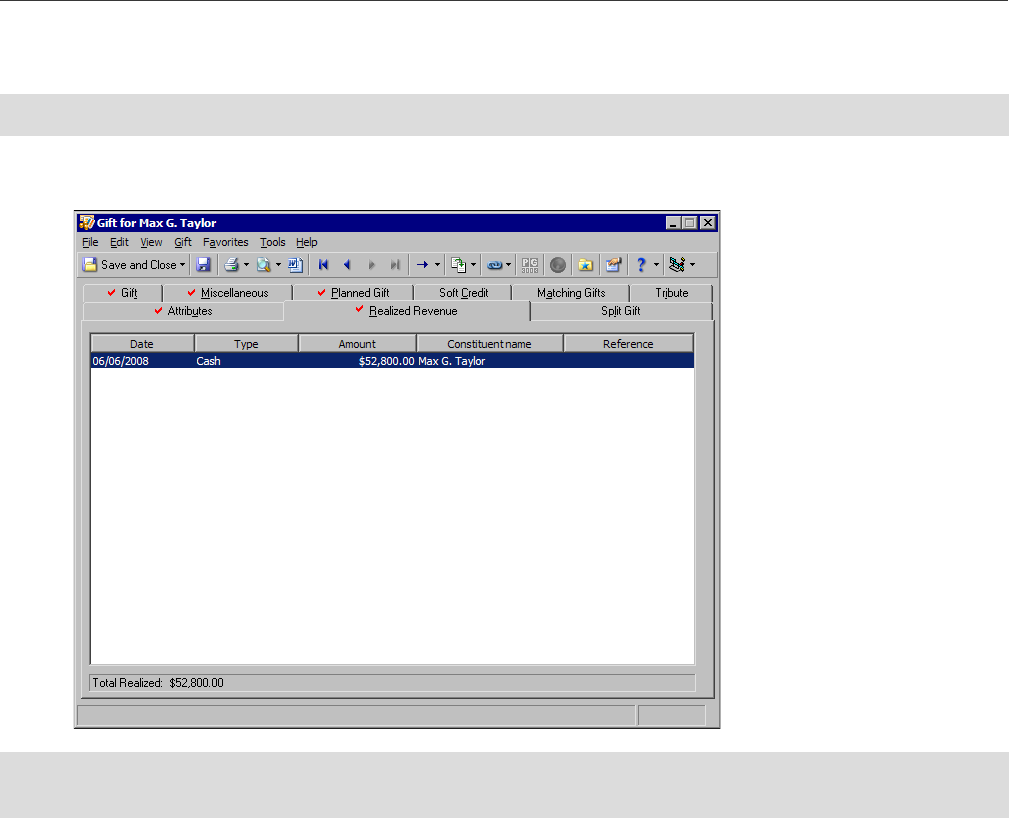

Realized Revenue Tab

In The Raiser’s Edge, you can add revenue realized from a planned gift or apply revenue received to a planned

gift. You can apply revenue received from gifts of cash, stock, property, gift-in-kind, or other types to a planned

gift. On the Realized Revenue tab of a planned gift record, you can view information about the revenue linked to

the planned gift. For each gift linked to the planned gift, you can view the date, gift type, amount, constituent, and

reference detail (if applicable) associated with the revenue. At the bottom of the tab, the Total Realized field

displays the sum of the revenue amounts associated with the planned gift.

P

LANNED

G

IFT

T

RACKING

25

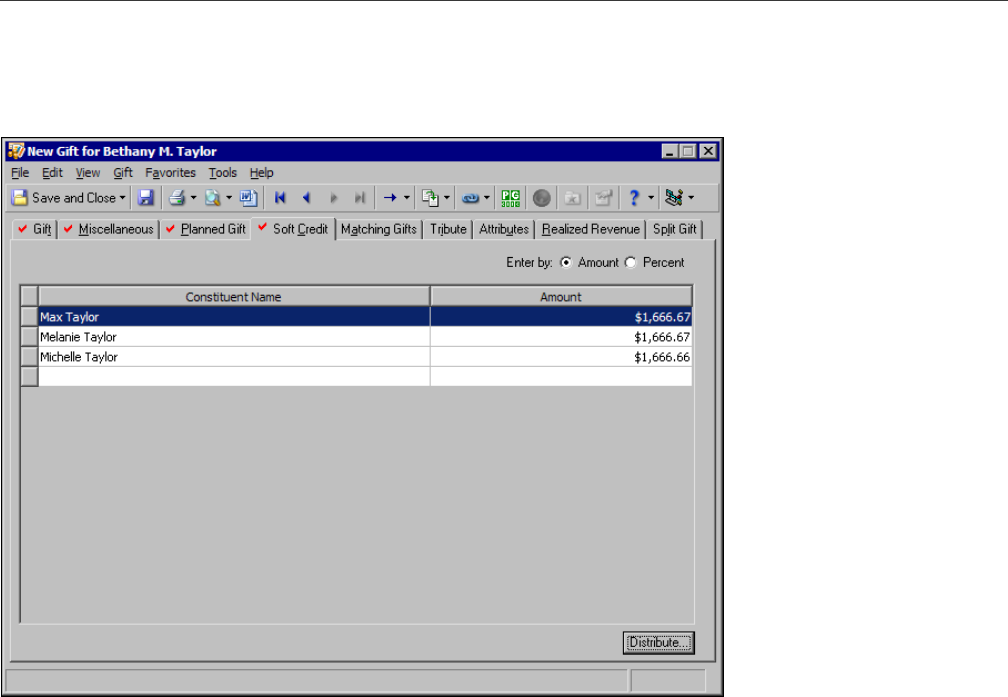

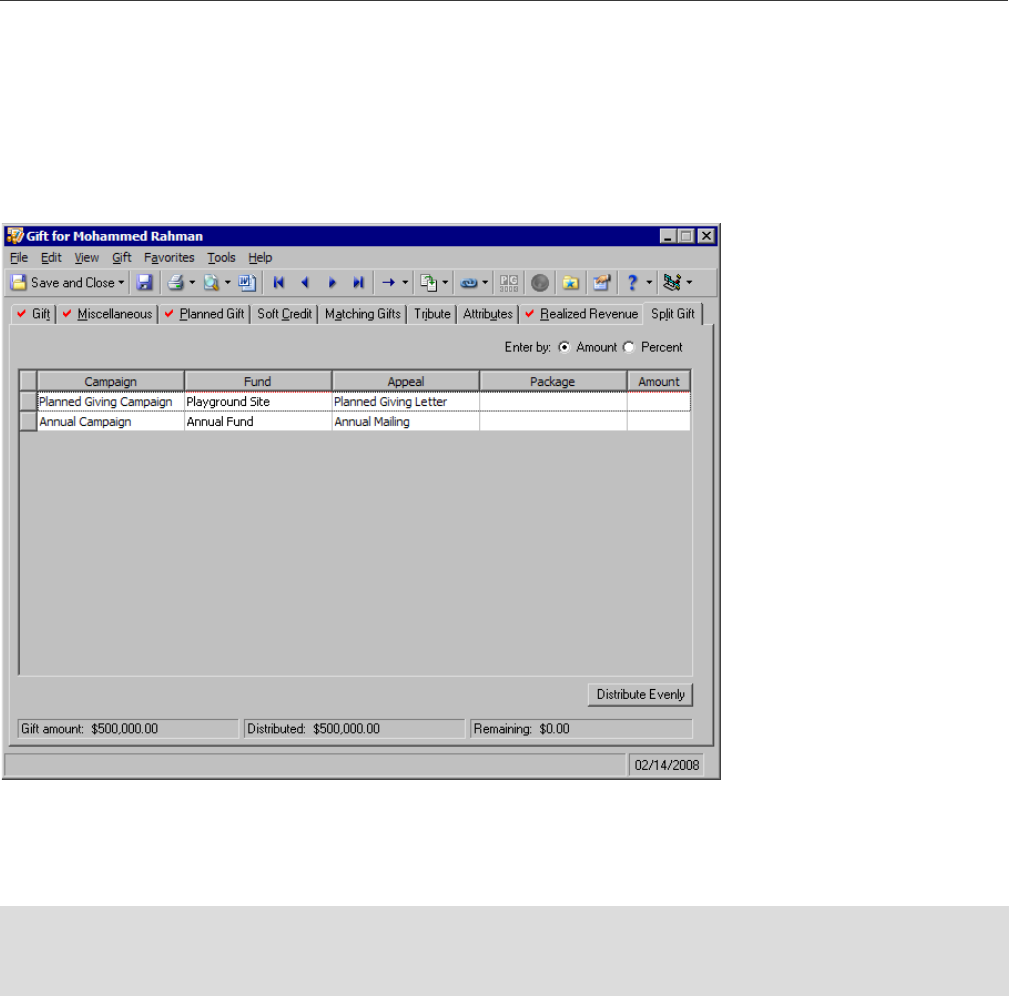

Split Gift Tab

On the Split Gift tab, you can divide a planned gift between multiple campaigns, funds, appeals, or packages.

When you split a gift, the program displays the campaigns, funds, appeals, and packages entered on the Split Gift

tab in the corresponding fields on the Gift tab. Then, the program disables the Campaign, Fund, Appeal, and

Package fields on the Gift tab. When you split a gift, you must edit the campaign, fund, appeal, and package

information on the Split Gift tab.

Track Planned Gifts

Once a donor officially commits to a planned gift for your organization, you can add a planned gift record to your

database in The Raiser’s Edge. Once all scheduled payments from the planned gift are made and the final

balance of the gift has been allocated to your final recipient(s), mark Gift has been realized and enter the

Remainder value/as of information on the Gift tab of the original planned gift record. After you understand the

tabs and options on a planned gift record, you can add a planned gift. For more information about the tabs on a

planned gift record, see “Understand the Planned Gift Record” on page 9. This section explains how to add, edit,

and delete planned gifts from the database.

Add a Planned Gift

When a donor commits to a planned gift, you must add a planned gift record to the database. To add this type of

gift, create a new gift record and enter the appropriate information for a planned gift.

Note: For more information about security for planned gifts, see the Configuration & Security Guide. For more

information about reports for planned gifts, see the Reports Guide and the Sample Reports Guide. For more

information about acknowledging gifts, see the Mail Guide.

26

C

HAPTER

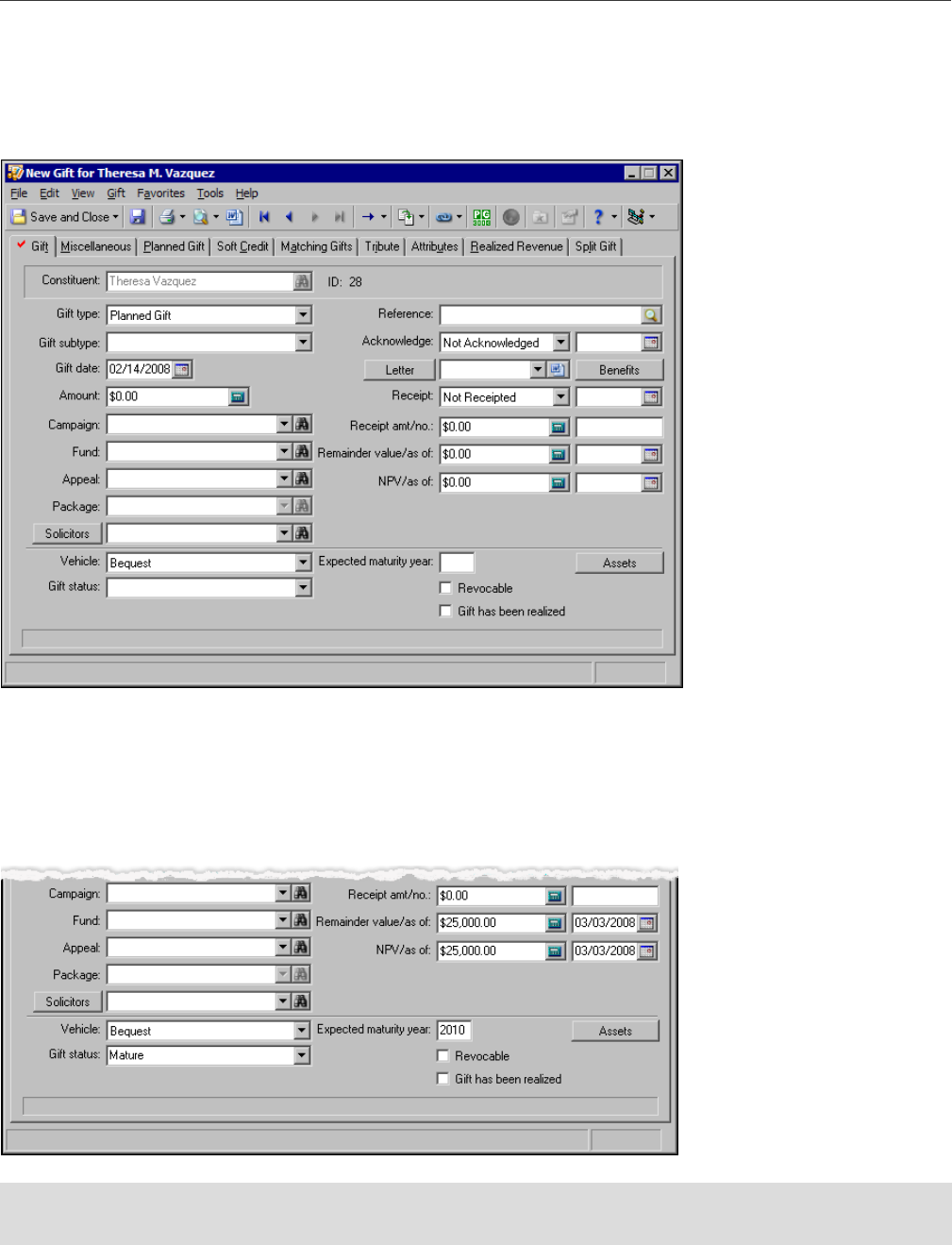

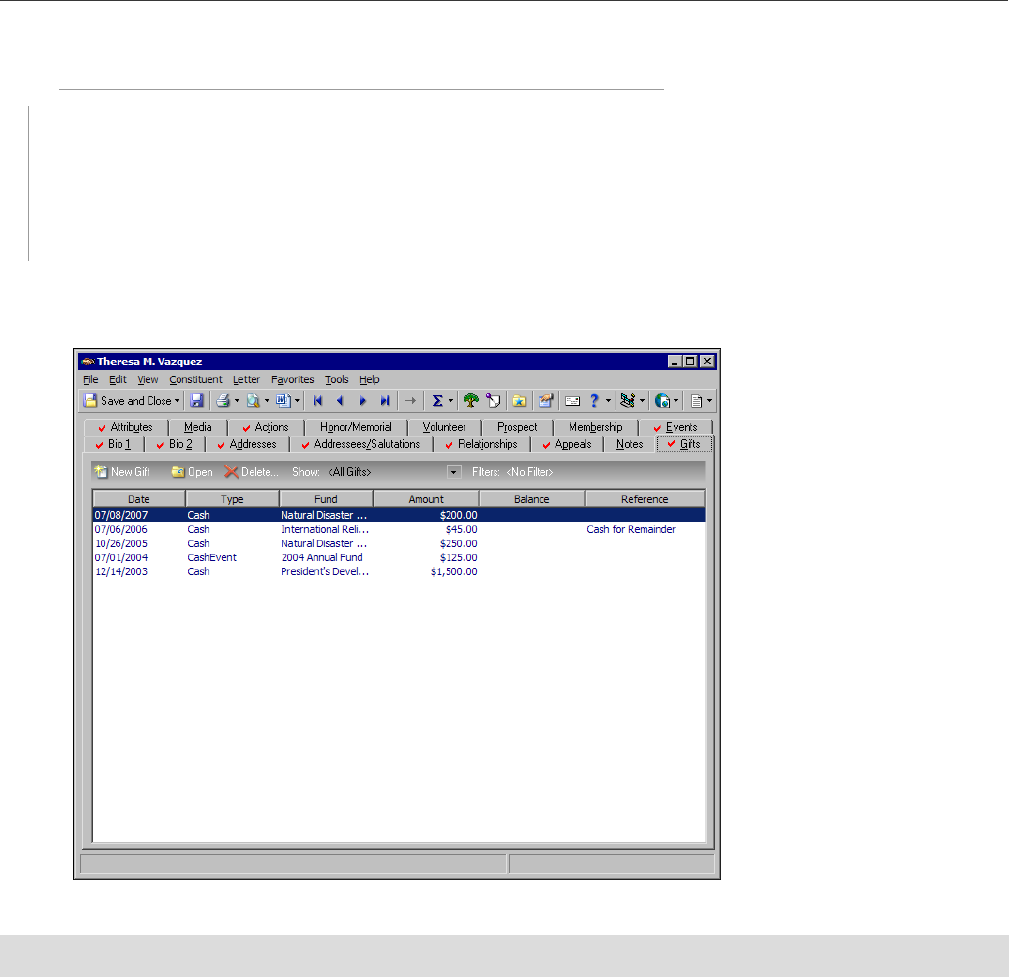

Add a planned gift for a Bequest

1. From Theresa Vazquez’s constituent record, select the Gifts tab. For more information about opening a

constituent record, see the Introduction to Constituent Records chapter of the Constituent Data Entry

Guide.

2. On the action bar, click New Gift. The New Gift screen appears.

Note: For more information about gift data entry, see the Gift Records Guide.

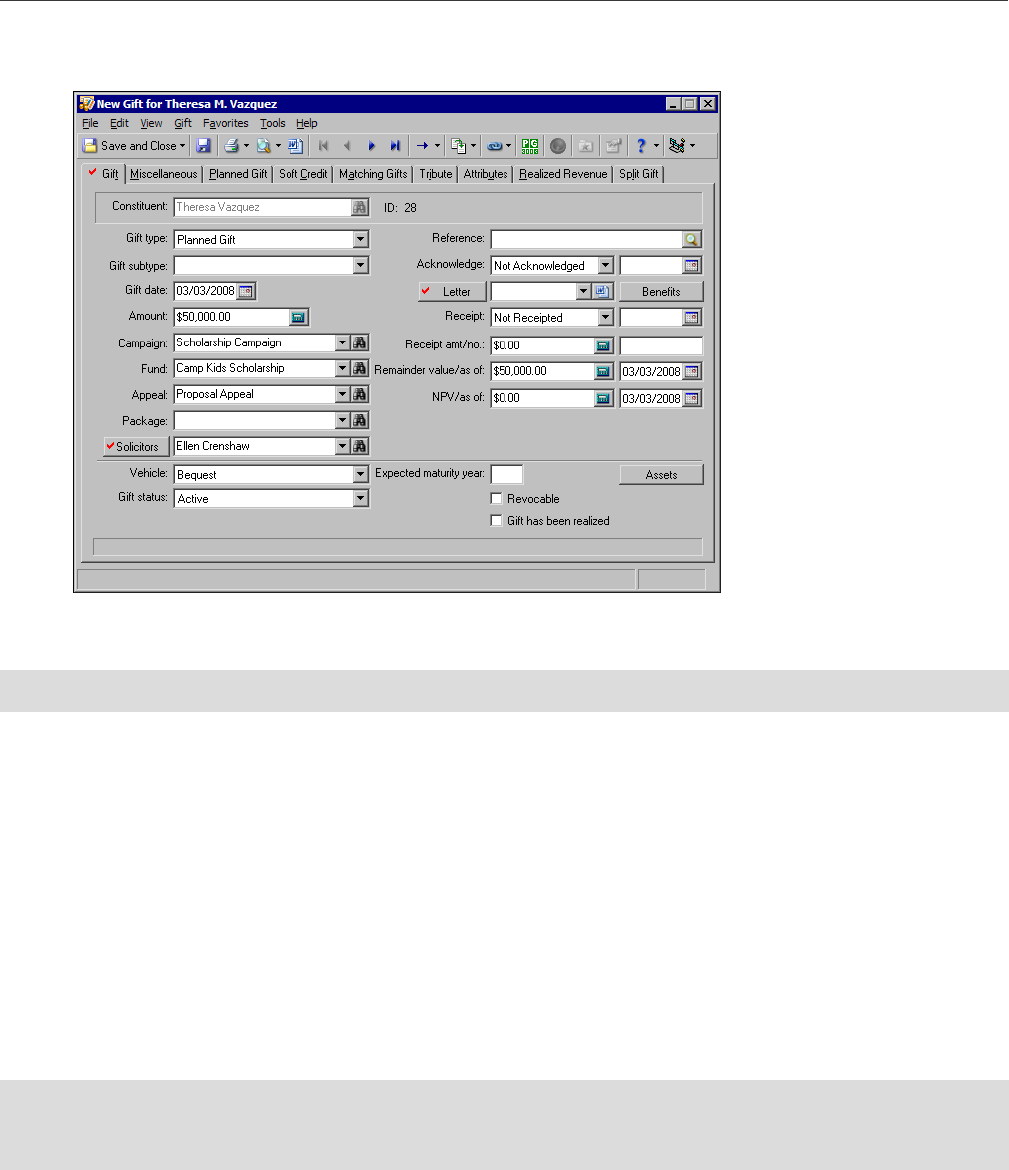

Scenario: On March 3, 2008, Theresa Vazquez committed to a $50,000 bequest gift to your

organization. Theresa requests that her gift go to the Scholarship Campaign and the Camp Kids

Scholarship fund. Your organization will receive the bequest at the time of her passing, and the

planned gift is revocable. Theresa’s commitment comes as a result of Ellen Crenshaw’s extensive

solicitation efforts. Theresa has appointed Attorney Hampton Judson as executor.

P

LANNED

G

IFT

T

RACKING

27

3. In the Gift type field, select “Planned Gift”. Additional fields for planned gifts, such as the Vehicle and

NPV/as of fields, appear.

4. In the Gift date field, enter the date the constituent commits to the planned gift to your organization,

such as 03/03/2008.

5. In the Amount field, enter the amount of the planned gift, such as “$50,000”.

6. In the Campaign field, select the campaign to which to apply the bequest, such as “Scholarship

Campaign”. To search the database for the campaign, click the binoculars.

7. In the Fund field, select the fund to which to apply the bequest, such as “Camp Kids Scholarship”. To

search the database for the fund, click the binoculars.

8. In the Appeal field, select the appeal used to solicit the planned gift, such as “Proposal Appeal”. To search

the database for the appeal, click the binoculars.

You can add a new campaign, fund, or appeal from a gift record. To do this, click Add New on the Open

screen when you search for a campaign, fund, or appeal. For more information, see the Campaigns,

Funds, and Appeals Data Entry Guide.

9. In the Solicitors field, select the solicitor associated with the planned gift. In this scenario, select Ellen

Crenshaw because Theresa committed to this planned gift because of Ellen’s solicitation efforts.

If multiple solicitors are associated with the planned gift, click Solicitors.

10. In the Remainder value/as of fields, enter an estimated remainder amount and date associated with the

remainder value.

We recommend the amount in the Remainder value field reflect the expected income amount for your

organization once all the conditions for a planned gift are met. In the as of date field, enter the last date

the remainder value amount was updated.

Note: If you do not know the planned gift amount, you can enter $0 in the Amount field.

Note: The Raiser’s Edge does not calculate the estimated remainder value or net present value (NPV)

amounts. We recommend you calculate these amounts in a third party software and enter them on

The Raiser’s Edge planned gift record.

28

C

HAPTER

11. In the NPV/as of fields, enter the net present value (NPV) and the current date, such as “$50,000” and

“03/03/2008”.

The NPV tracks what the gift is worth “today” when it matures. In the as of date field, enter the date you

enter or adjust the NPV amount.

12. In the Vehicle field, select “Bequest”.

13. In the Gift status field, select “Active”.

If you need an entry that does not exist in the Gift status field, you can type your entry directly into the

field if you have security rights established. A message appears and asks whether to add the entry to that

table. Click Yes. Even though you can add a table entry from a field with a drop-down list, for data entry

consistency, we recommend you establish your table entries from the Tables link of Configuration. For

information about setting up tables, see the Configuration & Security Guide.

14. In the Expected maturity year field, enter the year you predict the planned gift to be fully realized.

Typically, you leave this field blank because you cannot predict the year of the donor’s passing.

The Raiser’s Edge does not calculate the expected maturity year. If you can calculate an expected

maturity year, such as with a life expectancy table your organization has, you can enter in the year of your

calculation.

15. To include asset information, such as about a house, an automobile, or a stock asset for the donor, click

Assets. In this scenario, leave the Assets field blank.

16. To track the gift as a revocable planned gift, mark Revocable.

17. Do not mark Gift has been realized. Mark this checkbox only when a planned gift has been completed,

such as once the donor passes away.

18. Enter and select any additional gift information required on the Gift tab. For details about the remaining

fields on the Gift tab, see the Gift Records Guide.

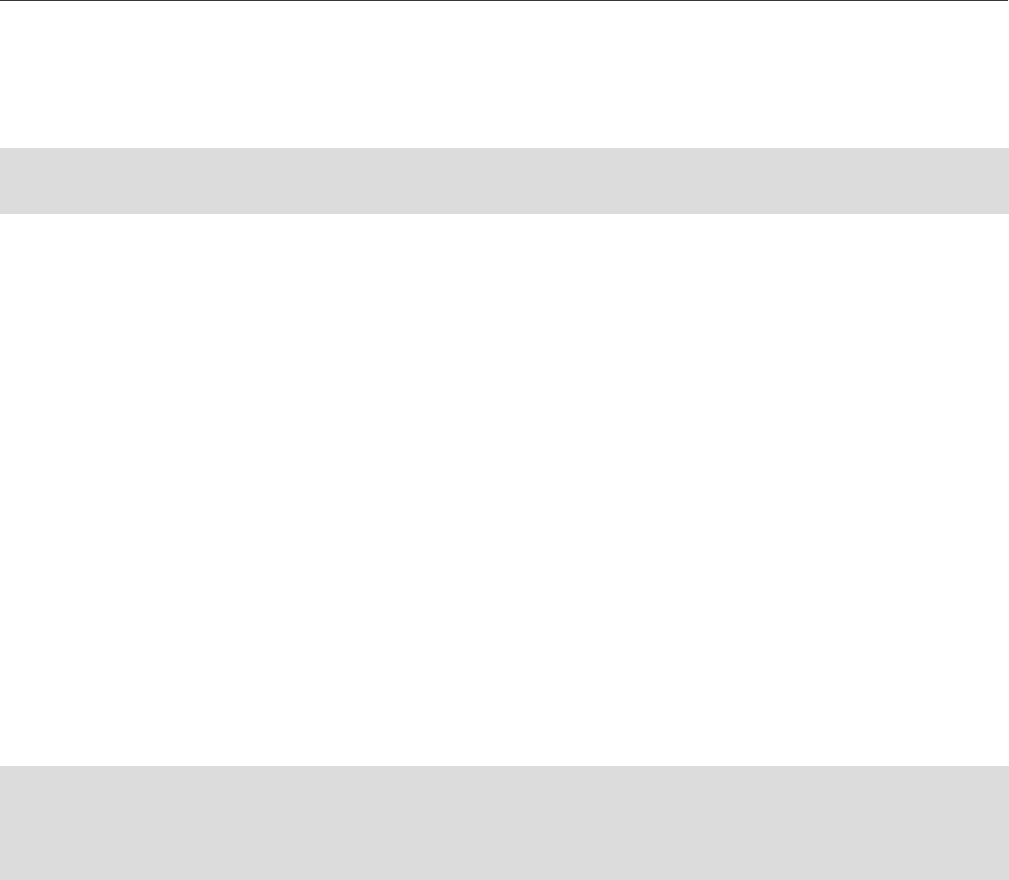

19. Select the Planned Gift tab.

20. In the Planned Gift Relationships grid, enter the names of any planned gift relationships. To enter a

name, click in the Name column. When you place the cursor in this field, the binoculars appear.

Warning: When you save a planned gift record, the Gift Vehicle field is disabled. To select a different vehicle

type, do so before you save the planned gift.

Note: People and organizations that appear on the Search relationships for screen, such as when you click the

binoculars in the Planned Gift Relationships grid, default from the Relationships tab on the constituent record.

To add a new relationship record, click Add New. To edit an existing relationship record, you must edit the

record from the Relationships tab.

P

LANNED

G

IFT

T

RACKING

29

In this scenario, because Theresa requests to use Hampton Judson as her attorney, click the binoculars to

search for Hampton. When you locate him, his name appears in the first row of the Name column. The

relationship, primary business, and position information default from the relationship record.

21. On the toolbar, click Save and Close. You return to the Gifts tab of the constituent record.

Once you receive money from the bequest, you must complete the planned gift record. To do this, mark

Gift has been realized and enter the final values in the Remainder value/as of and NPV/as of fields on the

Gift tab of the original planned gift record. For more information about how to edit a planned gift record,

see “Edit a Planned Gift” on page 40.

30

C

HAPTER

Add a planned gift for a lead annuity trust

There are multiple ways to track annuities in The Raiser’s Edge. This scenario uses the example of tracking a

lead annuity trust as an actual fund. You can also create one fund for all annuities. We do not recommend one

specific way but encourage you to research and find the best plan to suit your organization’s needs.

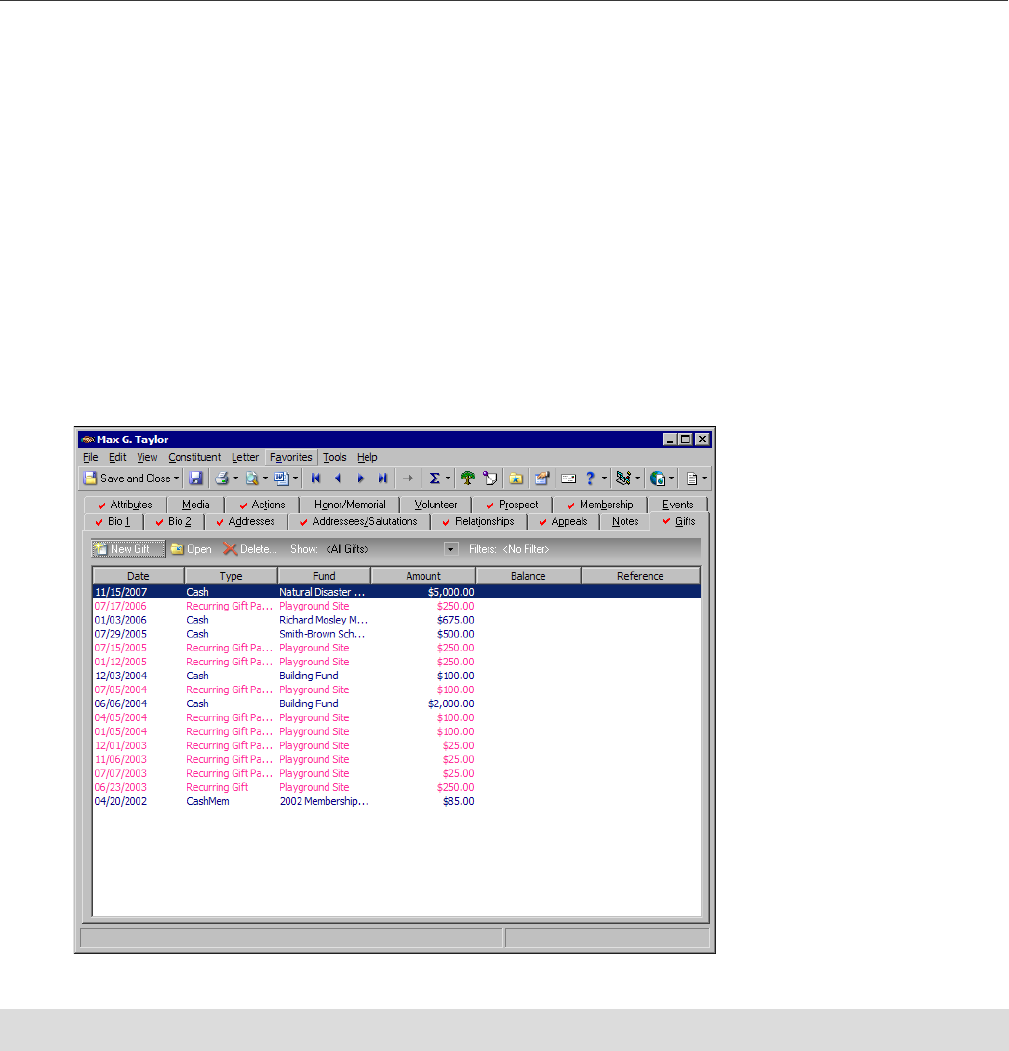

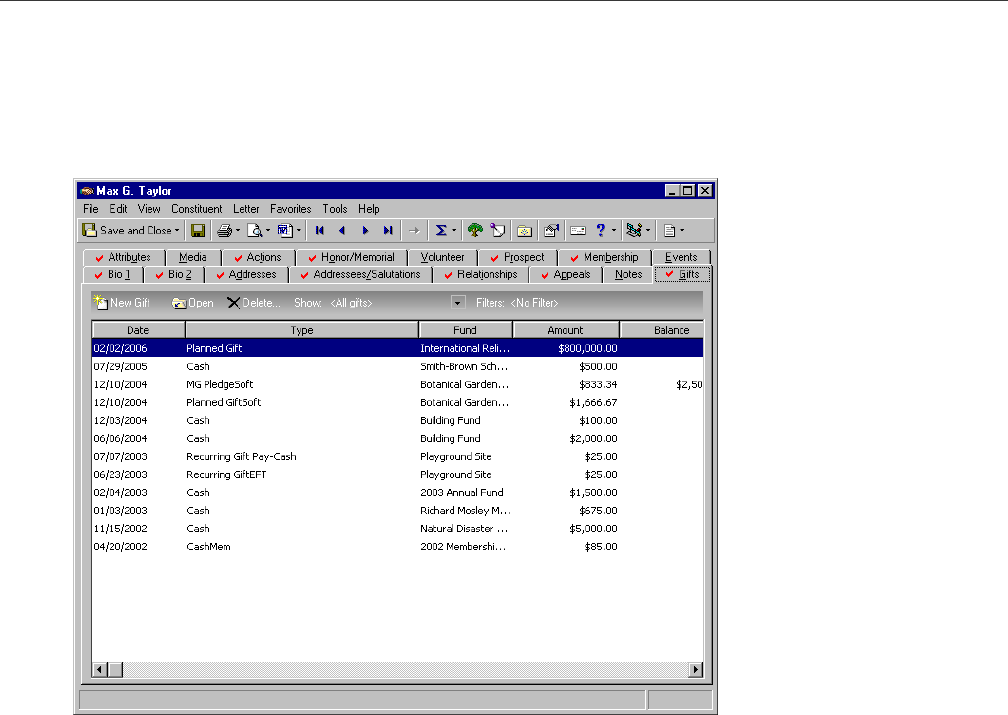

1. From Max Taylor’s constituent record, select the Gifts tab. For more information about how to open a

constituent record, see the Introduction to Constituent Records chapter of the Constituent Data Entry

Guide.

2. On the action bar, click New Gift. The New Gift screen appears.

Note: For more information about gift data entry, see the Gift Records Guide.

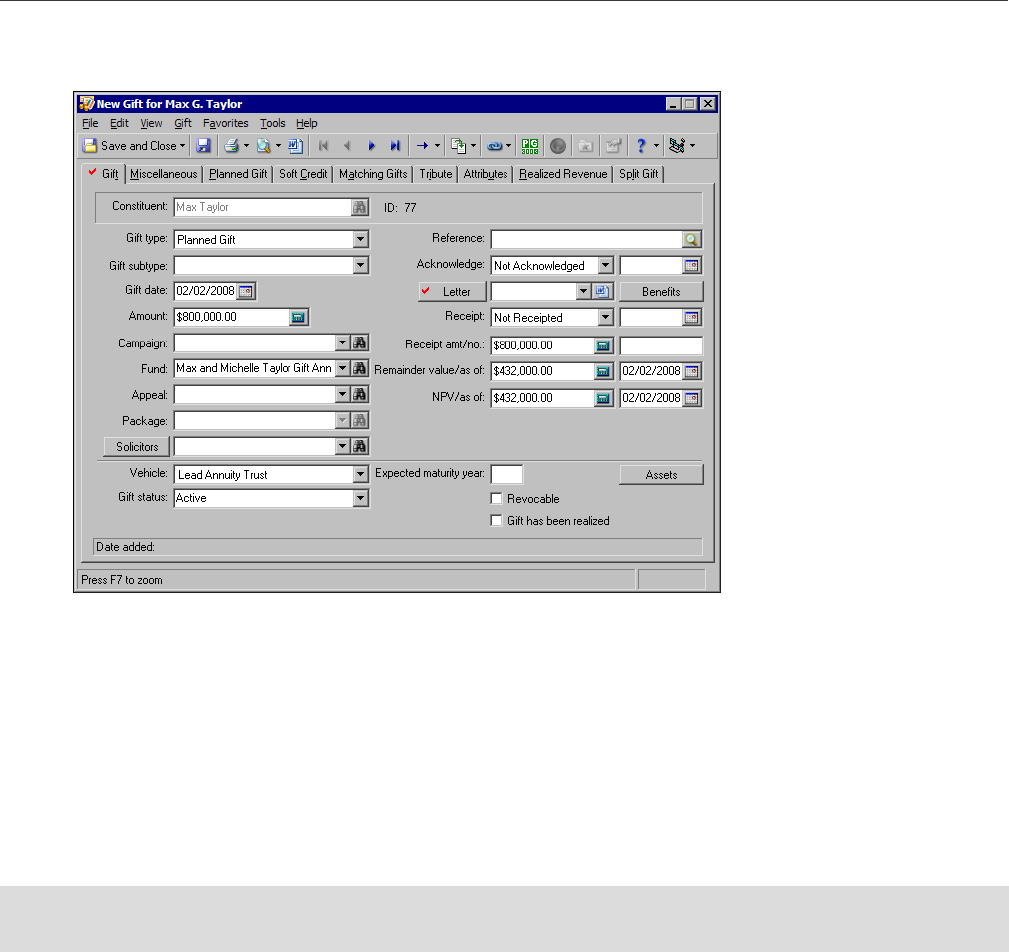

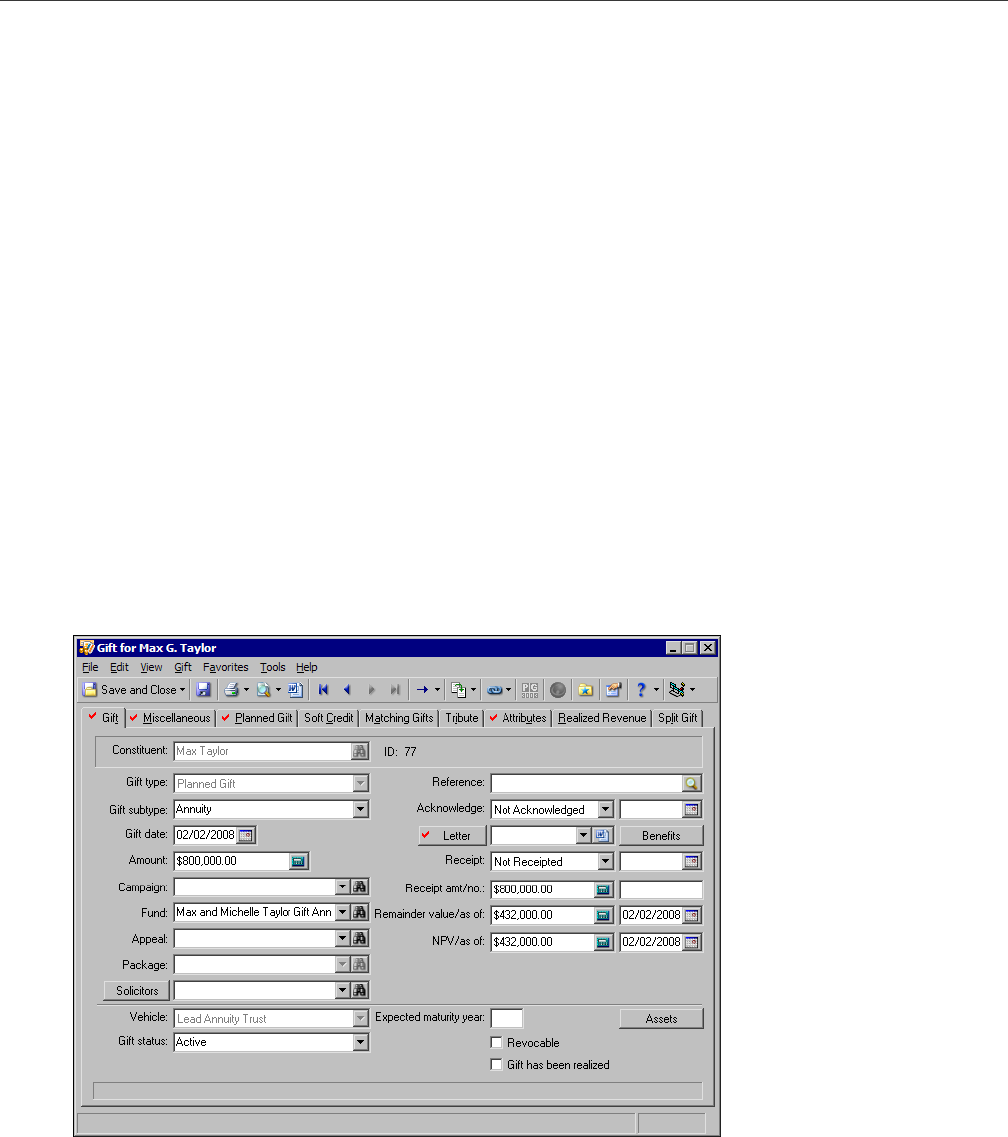

Scenario: Max Taylor commits to a lead annuity trust on February 2, 2008. He donates $800,000 for

the planned gift. He designates that your organization receives $50,000 of this amount on an annual

basis. These annual payments begin on June 6, 2008. Max wants to contribute earnings from the lead

annuity trust to the International Relief Fund. The lead annuity trust account is with the American

Savings and Loan bank account, Max’s preferred bank. This planned gift is not revocable.

P

LANNED

G

IFT

T

RACKING

31

3. In the Gift type field, select “Planned Gift”. Additional fields for planned gifts, such as the Vehicle and

NPV/as of fields, appear.

4. In the Gift date field, enter the date the constituent commits to the planned gift to your organization. For

example, enter “02/02/2008”, the date Max commits to a lead trust annuity.

5. In the Amount field, enter the amount of the planned gift, such as “$800,000”.

6. In the Fund field, select the fund to which to apply the planned gift, such as “Max and Michelle Taylor

Lead Annuity Trust Fund”.

In this scenario, we assume the organization tracks a lead annuity trust as an individual fund in

The Raiser’s Edge. For more information about how to add a fund to your database, see the Campaigns,

Funds, and Appeals Data Entry Guide.

7. In the Remainder value/as of fields, enter the amount and date associated with the remainder value,

such as “$432,000” and “02/02/2008”.

We recommend the amount in the Remainder value field reflect the expected income amount for your

organization once all conditions for a planned gift are met. In the as of date field, enter the last date the

remainder value amount was updated. For more information about this field, see “Edit a Planned Gift” on

page 40.

8. In the NPV/as of fields, enter the net present value (NPV) and the current date, such as “$432,000” and

“02/02/2008”.

The net present value (NPV) tracks what the gift is worth “today” when it matures. In the as of date field,

enter the last date you adjust the NPV amount.

9. In the Vehicle field, select “Lead Annuity Trust”.

When you save a planned gift record, the Vehicle field is disabled. To select a different vehicle type, do so

before you save the planned gift record.

10. In the Gift status field, select “Active”.

Note: The Raiser’s Edge does not calculate the estimated remainder value or net present value amounts.

Calculate these amounts in a third party software and enter them on The Raiser’s Edge planned gift record.

32

C

HAPTER

If you need an entry that does not exist in the drop-down list for the Gift status field, you can type your

entry directly into the field if you have security rights established. A message appears and asks whether to

add the entry to that table. Click Yes. Even though you can add a table entry from a field with a drop-down

list, for data entry consistency, we recommend you establish your table entries from the Tables link of

Configuration. For information about setting up tables, see the Configuration & Security Guide.

11. In the Expected maturity year field, enter the year you predict the planned gift to be fully realized.

Typically, you leave this field blank because you cannot predict the year of the donor’s passing.

The Raiser’s Edge does not calculate the expected maturity year. If you can calculate an expected

maturity year, such as with a life expectancy table your organization has, you can enter the year of your

calculation.

12. To include asset information for the donor, such as about a house, an automobile, or a stock asset for the

donor, click Assets. For this scenario, leave the Assets field blank.

13. To track a gift as a revocable planned gift, mark Revocable. For this scenario, Max’s Lead Annuity Trust is

not revocable, so do not mark this checkbox.

14. Do not mark Gift has been realized. Mark this checkbox only when a planned gift is completed or when its

time period has expired.

15. Enter and select any other gift information required. For details about the remaining gift fields, see the

Gift Records Guide.

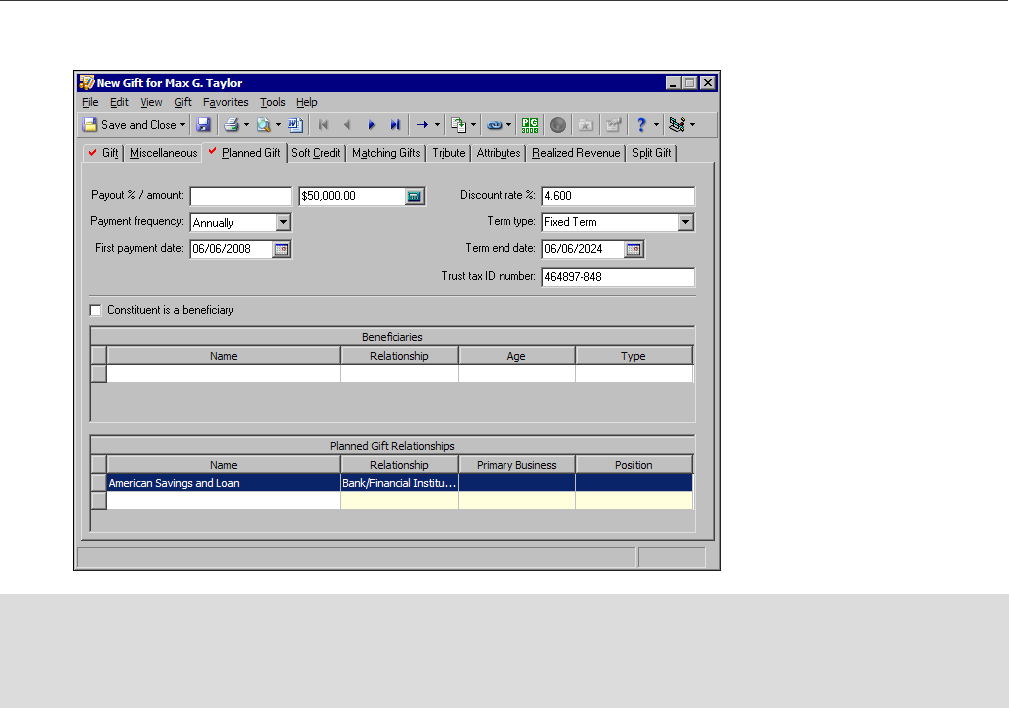

16. Select the Planned Gift tab.

17. In the Payout % / amount field, enter the payment amount your organization receives from the trust. In

this scenario, leave the Payout % field blank and, in the amount field, enter “$50,000”.

18. In the Payment frequency field, select the frequency at which your organization receives payments from

the trust, such as “Annual”.

19. In the First payment date field, enter the date of the first payment to your organization, such as

“06/06/2008”.

20. In the Discount rate % field, enter the current discount rate for planned gifts. You can obtain this rate

from the IRS.

21. In the Term type field, select whether the term of the retained life estate lasts until a fixed date, the life of

the constituent, or the shorter or longer of either.

Your selection in the Term type field affects the other fields that appear on the Planned Gifts tab. For

example, if you select “Fixed Term”, the Term end date field appears. In the Term end date field, enter the

projected end date of the term.

P

LANNED

G

IFT

T

RACKING

33

22. In the Trust tax ID number field, enter the federal tax ID number of the trust.

23. In the Beneficiaries grid, enter the beneficiaries for the lead annuity trust.

a. To enter the constituent as a beneficiary, mark Constituent is a beneficiary. In this scenario, since

Max does not receive income from the lead annuity trust, do not mark this checkbox.

b. To enter the name of a beneficiary, click the first cell in the Name column. When you put the cursor

in this field, the binoculars appear. Click the binoculars to search for a relationship record.

If the Relationships tab on the constituent record contains relationship and age information, this

information defaults in the Relationship and Age columns.

c. In the Type column, select beneficiary types. The types in the drop-down list depend on the gift

vehicle selected on the Gift tab. For example, for a lead annuity trust, select Donor, Non-Income, or

Donor + Non-Income.

24. In the Planned Gift Relationships grid, enter the names of the planned gift relationships, such as the

attorney or financial advisor who reviewed the annuity agreement for the constituent.

To enter the name of a planned gift relationship, click the first cell in the Name column. When you put the

cursor in this field, the binoculars appear.

In this scenario, because Max’s income distribution is sent to his American Savings and Loan bank

account, click the binoculars to search for American Savings and Loan. When you locate the bank, the

name appears in the first row of the Name column. The Relationship information defaults from the

relationship record.

If the Relationships tab on the constituent record contains primary business and position information, it

defaults in the Primary Business and Position columns.

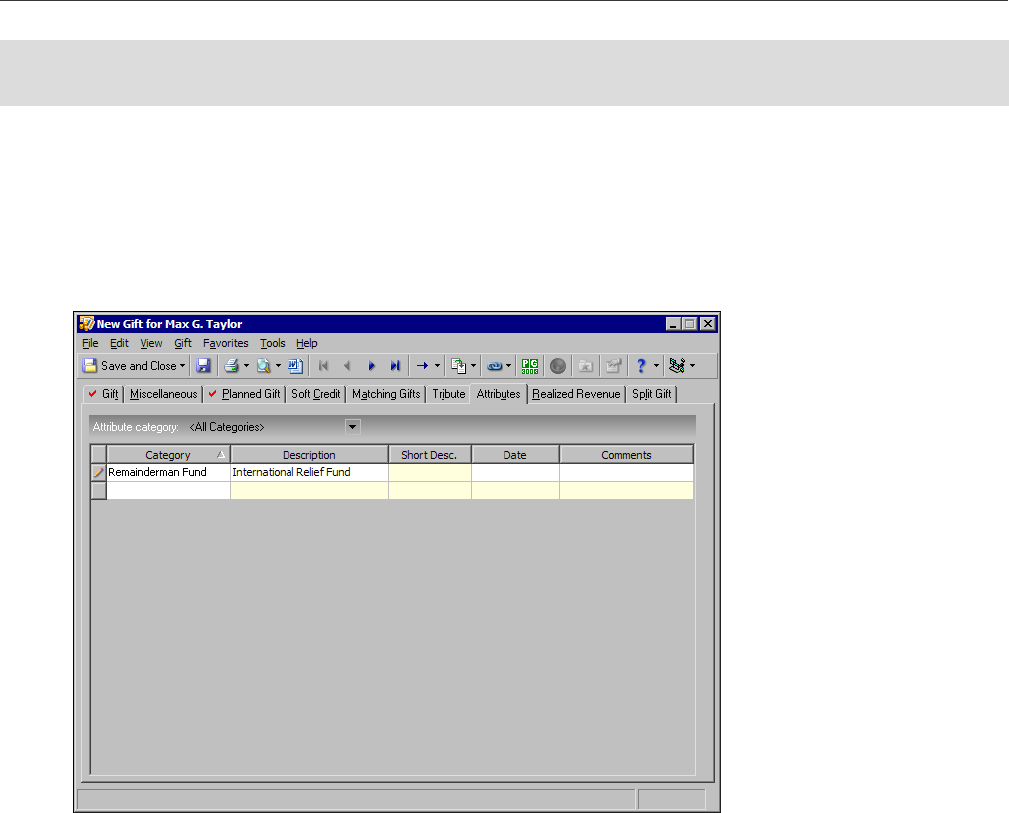

25. Select the Attributes tab.

26. In the Category column, select “Remainderman Fund”.

Note: People and organizations that appear on the Search relationships for screen, such as when you click the

binoculars in the Beneficiaries or Planned Gift Relationships grid, default from the Relationships tab on the

constituent record. To add a new relationship record, click Add New. To edit an existing relationship record,

you must edit the record from the Relationships tab.

34

C

HAPTER

27. In the Description column, enter the fund to which to apply the earnings from the lead annuity trust. In

this scenario, since Max requests that all earnings from his lead annuity trust go to the International Relief

Fund, enter “International Relief Fund”.

When you add a gift attribute to a lead annuity trust planned gift record, you can track the remainderman

fund for the remainder value of the annuity once all conditions have been met. In Reports, you can select

the gift attribute parameter for a certain remainderman fund to process a planned giving report on the

fund. For more information about planned giving reports, see the Reports Guide and the Sample Reports

Guide.

28. On the toolbar, click Save and Close. You return to the Gifts tab.

Once the lead annuity trust matures and all conditions are met, you must complete the planned gift

record. To do this, mark Gift has been realized and enter the values in the final Remainder value/as of

and NPV/as of fields on the Gift tab of the original planned gift record. For more information about how

to edit a planned gift record, see “Edit a Planned Gift” on page 40.

Note: If you need a gift attribute that does not exist for the planned gift, add the attribute to the database in

Configuration. For information about creating attributes, see the Configuration & Security Guide.

P

LANNED

G

IFT

T

RACKING

35

Add a planned gift for a retained life estate

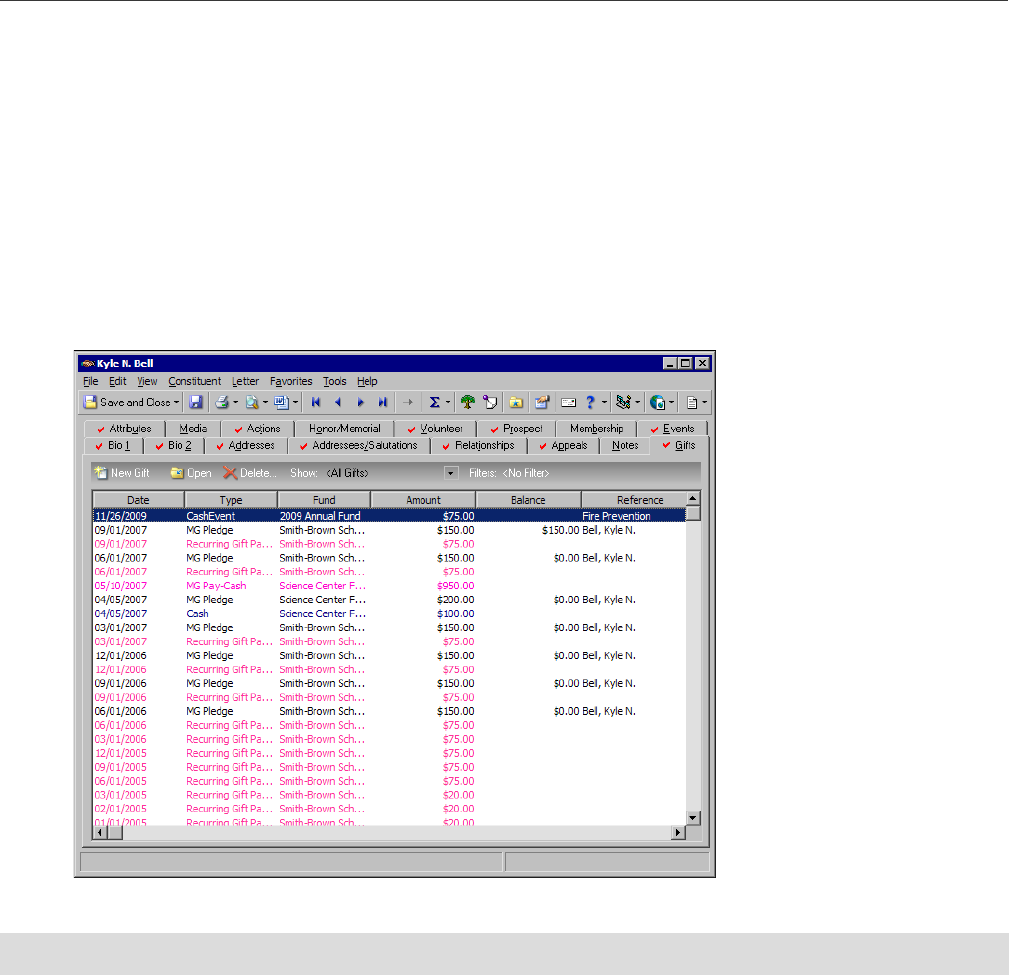

1. From Kyle Bell’s constituent record, select the Gifts tab. For more information about opening a

constituent record, see the Introduction to Constituent Records chapter of the Constituent Data Entry

Guide.

2. On the action bar, click New Gift. The New Gift screen appears.

Note: For more information about gift data entry, see the Gift Records Guide.

Scenario: Through a retained life estate, Kyle Bell plans to leave his home in Pahoa, Hawaii (worth

$2,500,000) to your organization. He states that if his wife Julia outlives him, she retains the right to

live in the house until the time of her passing. To track this information, you must create a planned gift

record for a retained life estate. Kyle wants to be eligible for tax benefits. Therefore, the gift is not

revocable. Lastly, Benjiman Connor is Kyle’s real estate attorney.

36

C

HAPTER

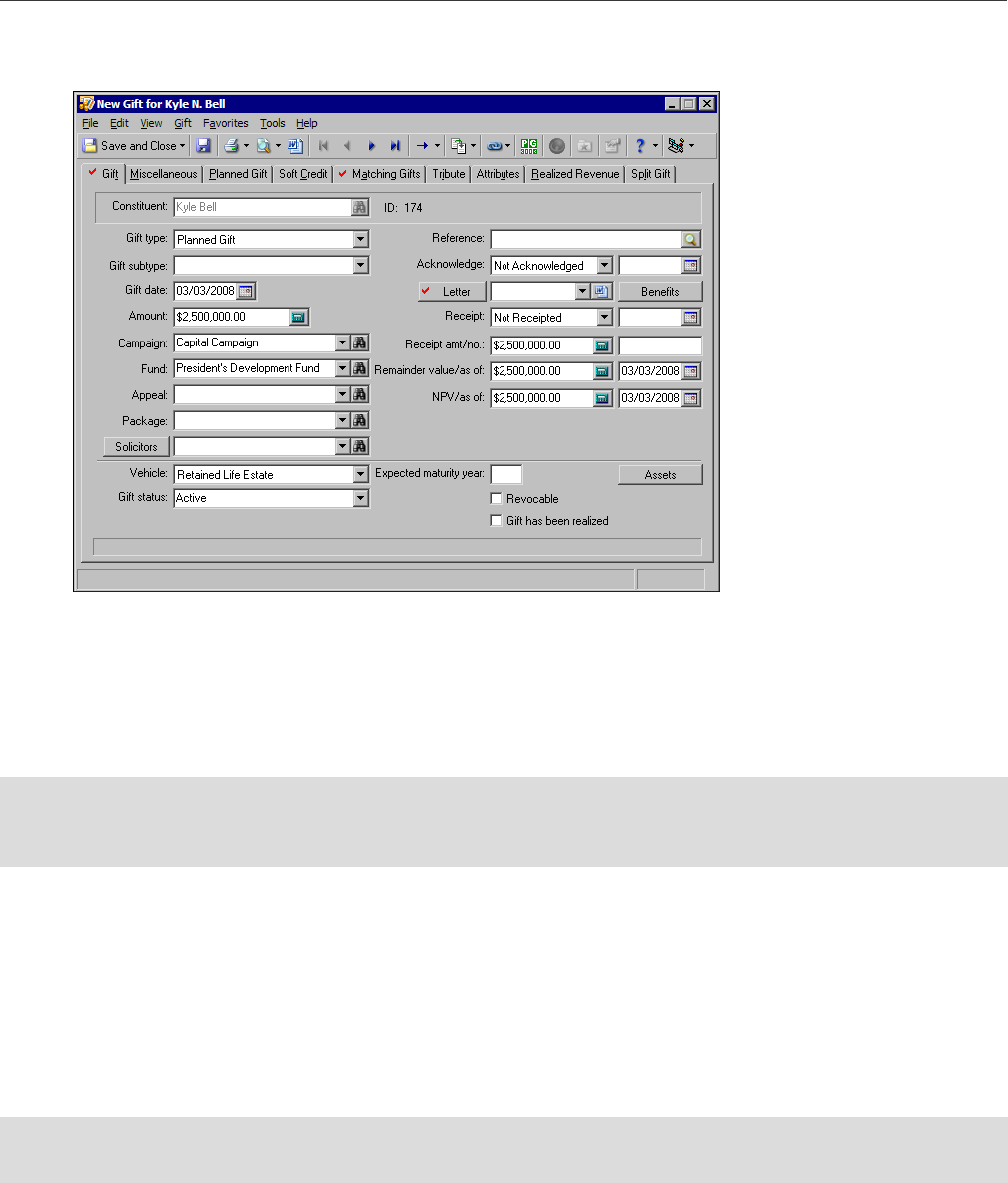

3. In the Gift type field, select “Planned Gift”. Additional fields for planned gifts, such as the Vehicle and

NPV/as of fields, appear.

4. In the Gift date field, enter the date the donor commits to the retained life estate.

5. In the Amount field, enter the amount of the planned gift, such as “$2,500,000”.

6. In the Campaign and Fund fields, enter the campaign and fund to which to apply the planned gift. In this

scenario, Kyle did not specify a campaign or fund for his retained life estate and left the designations up to

your organization. In the Campaign field, select “Capital Campaign”. In the Fund field, select “President’s

Development Fund”.

7. In the Remainder value/as of fields, enter the amount and date associated with the remainder value,

such as “$2,500,000” and your planned gift date.

We recommend the amount in the Remainder value field reflect the expected income amount for your

organization once all the conditions for a planned gift are met. In the as of date field, enter the last date

you adjusted the remainder value amount.

8. In the NPV/as of fields, enter the value and date associated with the net present value (NPV), such as

“$2,500,000” and the planned gift date.

The NPV tracks what the gift is worth “today” when it matures. In the as of date field, enter the last date

you adjusted the NPV amount.

9. In the Vehicle field, select “Retained Life Estate”.

Note: The Raiser’s Edge does not calculate the estimated remainder value or net present value (NPV)

amounts. We recommend you calculate these amounts in a third party software and enter them on

The Raiser’s Edge planned gift record.

Warning: When you save a planned gift record, the Vehicle field is disabled. To select a different vehicle type,

you must do so before you save the planned gift.

P

LANNED

G

IFT

T

RACKING

37

10. In the Gift status field, select “Active”.

11. In the Expected maturity year field, enter the year you predict the planned gift to be fully realized. In this

scenario, because you cannot predict the year of Kyle’s or his wife’s passing, leave this field blank.

The Raiser’s Edge does not calculate the expected maturity year. If you can calculate an expected

maturity year, such as with a life expectancy table your organization has, you can enter in the year of your

calculation.

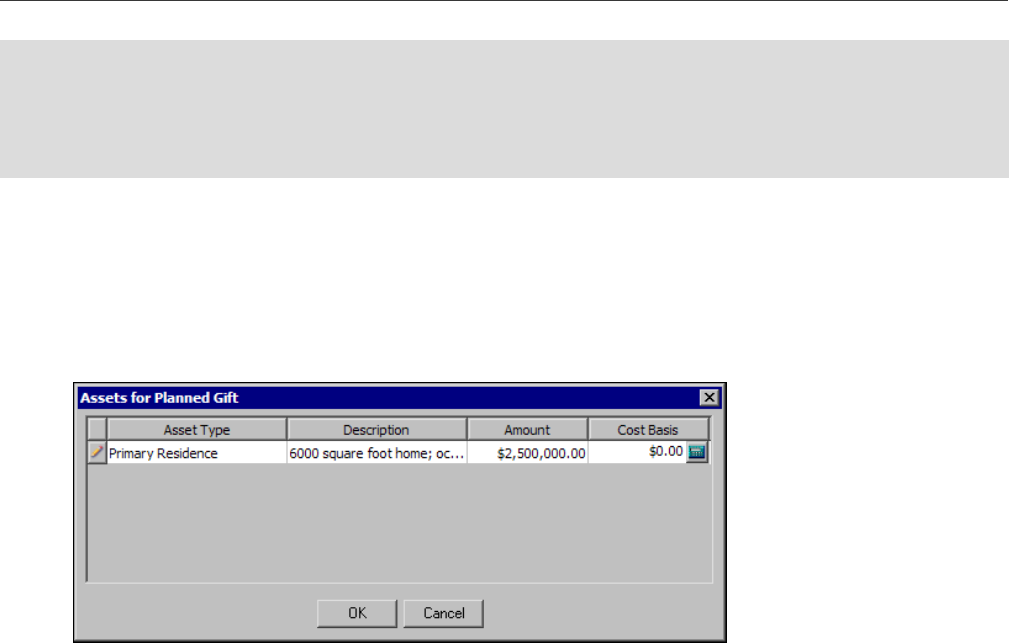

12. To include asset information about the estate, click Assets. The Assets for Planned Gift screen appears.

a. In the Asset Type column, select the type of asset associated with the planned gift. In this scenario,

select “Primary Residence”.

b. In the Description column, enter a description or details of the asset, such as “6000 square foot

home; ocean front”.

c. In the Amount column, enter the current value of the asset. For this scenario, enter “$2,500,000”,

the current worth of the Pahoa, Hawaii house.

d. Typically, you do not track the cost basis for a retained life estate. Therefore, in the Cost Basis

column, leave the default “$0”.

The Cost Basis column displays the cost of the asset at the time your organization receives it. A gift

of stock is an example of an asset for which you want to track cost basis.

e. To return to the Gift tab, click OK.

13. To specify the planned gift as recovable, mark Revocable. In this scenario, Kyle wants to be eligible for tax

benefits for this retained life estate, so do not mark this checkbox.

14. Do not mark Gift has been realized. You mark this checkbox only when a planned gift has been

completed, such as once Kyle and his wife both pass away.

15. Enter and select any other gift information required. For details about the remaining gift fields, see the

Gift Records Guide.

Note: If you need an entry that does not appear as a selection in the Gift status field, you can type your entry

directly into the field if you have security rights established. A message appears to ask whether to add the entry

to that table. Click Yes. Even though you can add a table entry from a field with a drop-down list, for data entry

consistency, we recommend you establish your table entries from the Tables link of Configuration. For

information about setting up tables, see the Configuration & Security Guide.

38

C

HAPTER

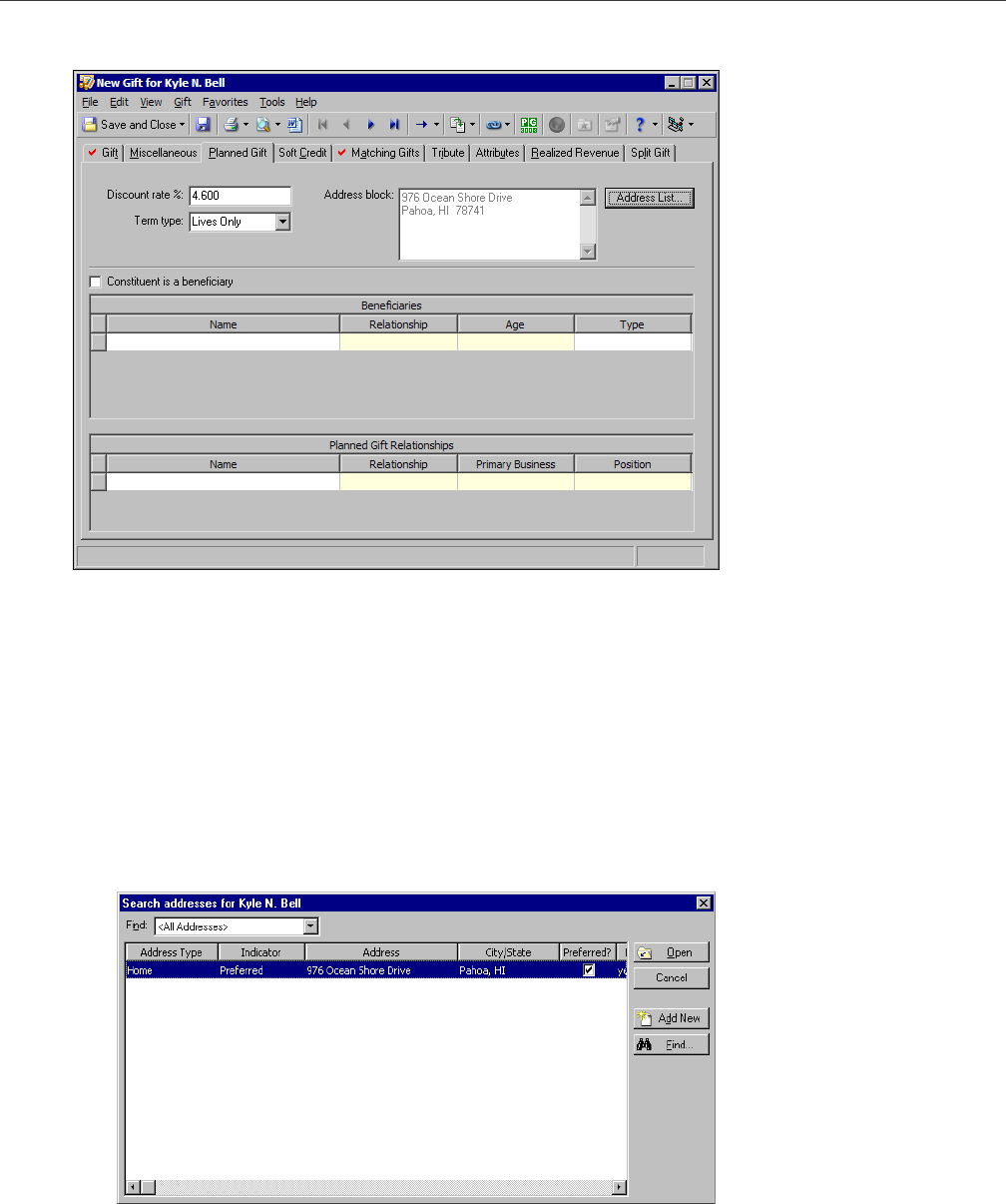

16. Select the Planned Gift tab.

17. In the Discount rate % field, enter the current discount rate for planned gifts. You can obtain this rate

from the IRS.

18. In the Term type field, select whether the term of the retained life estate lasts until a fixed date, the life of

the constituent, or the shorter or longer of either. In this scenarion, select “Lives Only”.

Your selection in the Term type field affects the other fields that appear on the Planned Gifts tab. For

example, if you select “Fixed Term”, the Term end date field appears. In this field, enter the projected end

date for the term.

19. In the Address block box, enter the address associated with the retained life estate.

To select the address:

a. Click Address List. The Search Addresses for screen appears and displays the addresses associated

with the constituent.

b. In the grid, select the address associated with the retained life estate.

c. Click Open. You return to the Planned Gift tab of the planned gift record. In the Address block box,

the selected address automatically appears.

P

LANNED

G

IFT

T

RACKING

39

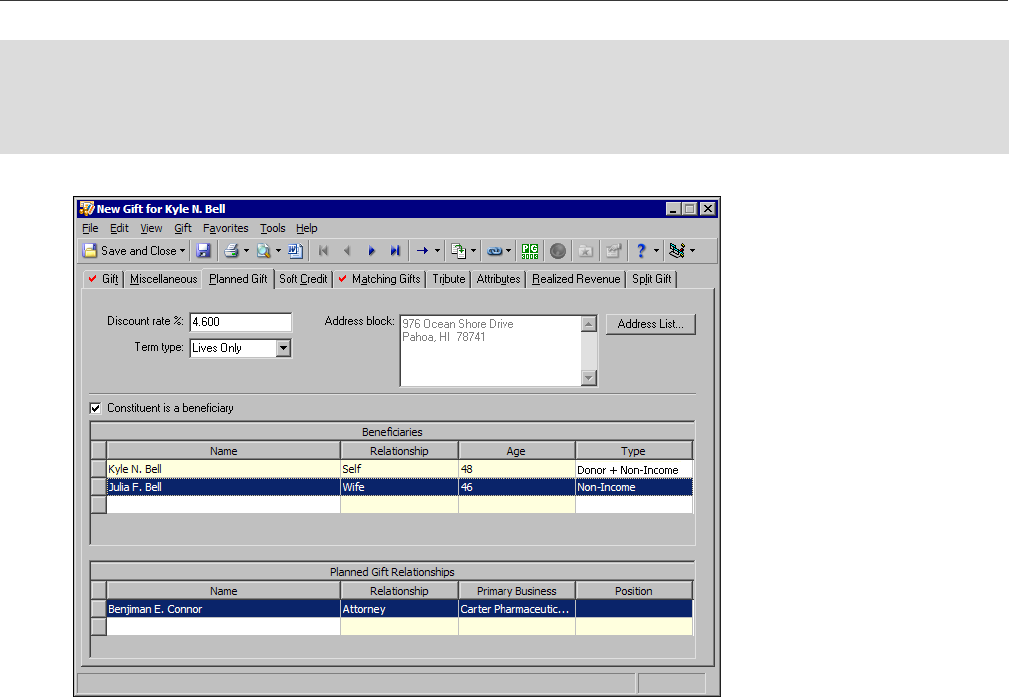

20. In the Beneficiaries grid, enter the beneficiaries for the retained life estate.

a. If the constituent is a beneficiary of the planned gift, mark Constituent is a beneficiary. In this

scenario, since Kyle retained the right to use the house until his passing, mark this checkbox.

When you mark Constituent is a beneficiary, the donor’s name defaults automatically in the

Beneficiaries grid.

b. To enter the name of another beneficiary, click the second cell in the Name column. When you put

the cursor in this field, the binoculars appear. In this scenario, because Kyle requests that his wife

Julia retains the right to remain in the house until her passing if she outlives him, click the binoculars

to search for Julia Bell.

When you locate Julia, her name appears in the first row of the Name column. The relationship and

age information default from the relationship record.

c. In the Type column, select the beneficiary type of the beneficiaries. In this scenario, select “Donor +

Non-Income” for Kyle since he is the primary donor of the planned gift and does not receive a

monetary benefit from the gift. For Julia, select “Non-Income” since she does not receive income

from the organization for the planned gift.

The selections in the Type field depend on the vehicle selected on the Gift tab. For example, for a

retained life estate, you can select a “Donor”, “Non-Income”, or “Donor + Non-Income”.

21. In the Planned Gift Relationships grid, enter the names of planned gift relationships, such as the attorney

or financial advisor who reviewed the estate agreement for the constituent.

To enter a planned gift relationship, click the first cell in the Name column. When you put the cursor in

this field, the binoculars appear. In this scenario, because Kyle requests to use Benjiman Connor as his

attorney, click the binoculars to search the database for Benjiman.

When you find Benjiman in the database, his name appears in the first row of the Name column. The

relationship, primary business, and position information default from the relationship record.

Note: People and organizations that appear on the Search relationships for screen, such as when you click the

binoculars in the Beneficiaries or Planned Gift Relationships grid, default from the Relationships tab on the

constituent record. To add a new relationship record, click Add New. To edit an existing relationship record,

you must edit the record from the Relationships tab.

40

C

HAPTER

22. On the toolbar, click Save and Close. You return to the Gifts tab of the constituent record.

Once you receive money from the home, such as when the planned gift matures and the home is sold,

you must complete the planned gift record. To do this, mark Gift has been realized and enter the final

values in the Remainder value/as of and NPV/as of fields on the Gift tab of the original planned gift

record. For more information about how to edit a planned gift record, see “Edit a Planned Gift” on

page 40.

Edit a Planned Gift

We recommend you edit a planned gift for two main reasons.

• When you receive a payment for the planned gift, you can create a gift record for the payment that links to the

original planned gift record. To link a payment for a planned gift, open the planned gift record. The new gift is

created from the original planned gift record. If the gift record exists, open the gift record to link it to a planned

gift record.

• When the planned gift matures, you can complete the planned gift record. To do this, you must edit planned

gift information on the Gift tab of the original planned gift record. You can edit a gift record if you have security

rights. For more information about security, see the Configuration & Security Guide.

You may also edit a planned gift to update the Remainder value/as of and NPV/as of fields. We recommend you

update this information periodically throughout the life of the planned gift.

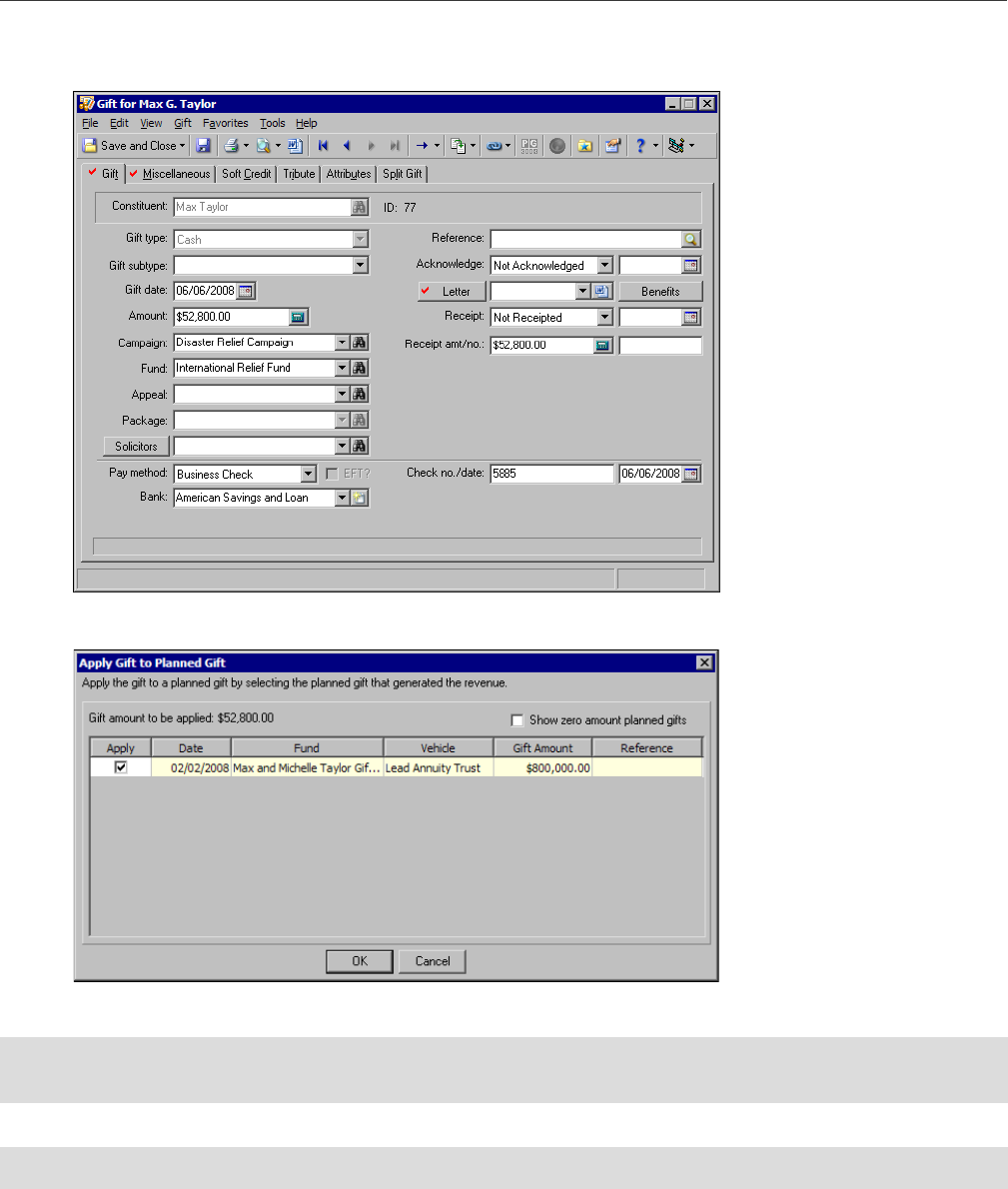

Create and link a new payment to a planned gift

1. Open the planned gift record to link to the new gift. For more information about how to open a planned

gift record, see “Open an existing planned gift from the Records page” on page 5.

2. On the menu bar, select Gift, Add Revenue Realized from Planned Gift. A new gift record appears.

Some information from the planned gift record, such as from the Amount, Fund, and Letter fields, default

into the appropriate fields on this gift record.

3. In the Gift type field, select the type of gift received. You can select “Cash”, “Stock/Property”,

“Gift-in-Kind”, or “Other”.

P

LANNED

G

IFT

T

RACKING

41

4. Enter and select any other gift information required. For details about the remaining gift fields, see the

Gift Records Guide.

5. To save the payment, click Save and Close on the toolbar. You return to the planned gift record.

6. To view the linked gift information, select the Realized Revenue tab.

7. To access another linked gift from the Realized Revenue tab, from the Gift menu, select Go to.

8. To close the planned gift record, select Save and Close on the toolbar.

Link an existing gift record to a planned gift record

You can link an existing gift record as a payment for a planned gift record if these conditions are met:

• The constituent has an existing planned gift record.

• The gift type is Cash, Stock/Property, Gift-In-Kind, or Other.

• The gift record does not include a matching gift.

• You have security rights to edit planned gift records.

Note: To view the planned gift record, click View linked Planned Gift.

Note: The Realized Revenue tab does not calculate a planned gift balance. The tab only calculates a total

amount for received gifts.

42

C

HAPTER

1. Open the existing gift record to apply to the planned gift. For more information about how to open a gift

record, see “Open an existing planned gift from the Records page” on page 5.

2. From the Gift menu, select Apply to, Planned Gift. The Apply Gift to Planned Gift screen appears.

3. In the Apply column, mark the checkbox next to the planned gift to which to apply the gift.

4. Click OK. You return to the Gift tab of the gift record.

5. To close the gift record, select Save and Close on the toolbar.

Note: To break the link between the gift record and the planned gift record, unmark the checkbox on the

Apply Gift to Planned Gift screen and click OK.

Note: To view the planned gift record, click View linked Planned Gift.

P

LANNED

G

IFT

T

RACKING

43

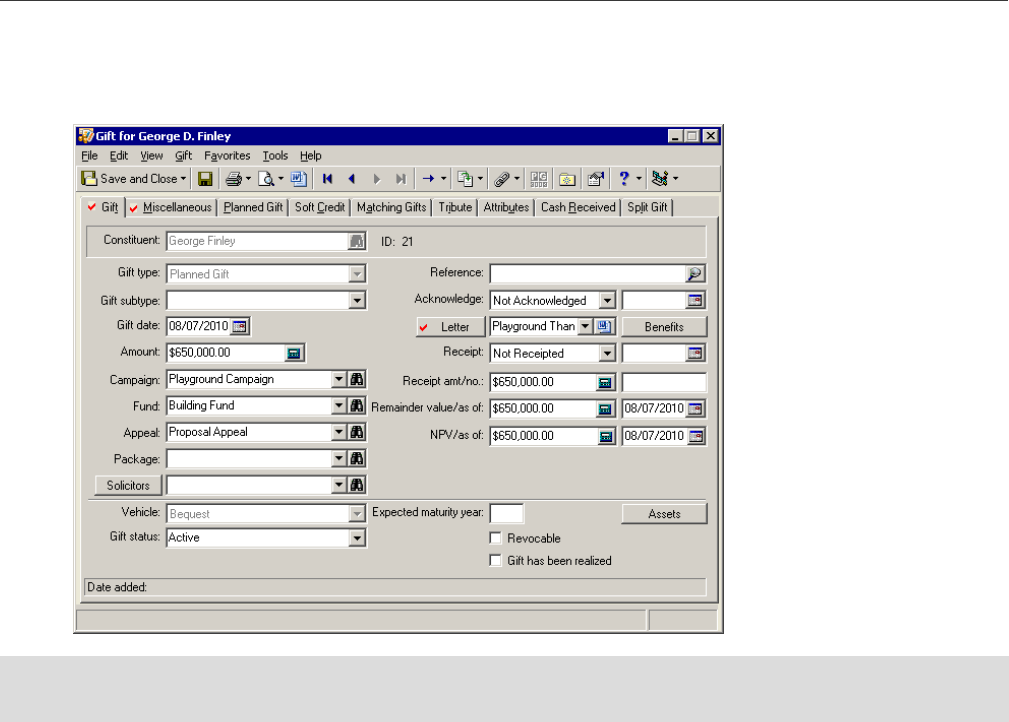

Edit a planned gift record for a mature planned gift

1. Open the existing planned gift record and select the Gift tab. For more information about how to open a

planned gift record, see “Open an existing planned gift from the Records page” on page 5.

2. In the Remainder value/as of field and the NPV/as of field, enter the remainder value and the net present

value (NPV).

3. In the Gift status field, select “Mature”.

If the selection you need does not appear in the Gift status field, you can type your entry directly into the

field if you have security rights established. A message appears and asks whether to add the entry to that

table. Click Yes. Even though you can add a table entry from a field with a drop-down list, for data entry

consistency, we recommend you establish your table entries from the Tables link of Configuration. For

information about setting up tables, see the Configuration & Security Guide.

4. In the Expected maturity year field, enter the year the planned gift matured.

Note: To recall the remainderman fund for the remainder value, select the Attributes tab. You can track

remainderman funds as a gift attribute.

44

C

HAPTER

5. Because all conditions of the planned gift are met, mark Gift has been realized.

To link a gift to the planned gift record, see “Create and link a new payment to a planned gift” on page 40

or “Link an existing gift record to a planned gift record” on page 41.

6. To close and save the planned gift record, click Save and Close on the toolbar.

Delete a Planned Gift

If you have security rights, you can delete a gift record from the database. We strongly recommend you make a

backup copy of the database before you delete any information from The Raiser’s Edge.

When you delete a gift record that is linked to a planned gift record, a warning message appears to confirm the

deletion of the gift. If you click Yes, the program deletes the gift and breaks the link between it and the planned

gift.

P

LANNED

G

IFT

T

RACKING

45

Delete a planned gift from the Gifts tab of a constituent record

If you delete a planned gift that is linked to a gift record, a warning message appears to confirm the deletion

of the planned gift. If you click Yes, the program breaks the link between the gifts and deletes the planned gift.

1. From a constituent record, select the Gifts tab. For more information about how to access a constituen

t

record, see the Introduction to Constituent Records chapter of the Constituent Data Entry Guide.

2. In the grid, select the gift to delete.

3. On the action bar, click Delete. A message appears to confirm the deletion of the gift record.

4. To delete the gift record, click Yes.

5. To save the changes and close the constituent record, click Save and Close on the toolbar.

46

C

HAPTER

2chapter

Planned Gifts Migration

Tool

Planned Gifts Migration Tool . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

Step 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Step 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Step 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Planned Gifts Migration Tool Exceptions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

48

C

HAPTER

Planned Gifts Migration Tool

With PlannedGiftTracker for The Raiser’s Edge, you can create gift records with a gift type of Planned Gift. These

records contain fields unique to planned giving. Previously, you may have stored planned gifts in The Raiser’s

Edge as Other gift records using gift attributes, gift subtypes, or gift codes. The Planned Gifts Migration Tool

migrates these records into new planned gift records using the new fields for planned giving.

During the migration, you can select to generate a static query of the original gift records copied to new planned

gift records. After the migration is complete, you may want to perform a global delete of the original gift records.

If you do this, you can use the generated static query to clean up your gift records.

The Raiser’s Edge does not currently support the posting of planned gifts to the general ledger. If the planned

gifts you want to migrate are posted, you must post the appropriate amounts for the new planned gift records to

your accounting software - not through The Raiser’s Edge. If you delete the original gift records following

migration, the posted amounts for the original gifts are offset in the general ledger.

• You must run the Planned Gifts Migration Tool from a machine that has The Raiser’s Edge installe

d.

• Every screen in the Planned Gifts Migration Tool provides instructional information. For a successful migration,

read and understand all of the information before processing.

• To use the Planned Gifts Migration Tool, you must have Supervisor rights to The Raiser’s Edge.

• With this tool, you can only migrate planned gifts stored in The Raiser’s Edge as gift subtypes, gift attributes, or

gift codes. For information about how to migrate data not supported by this tool, contact

• For information about PlannedGiftTracker, see the Planned Gift Tracking Guide.

Note: For information about how to download and install the Planned Gifts Migration Tool, refer to

Knowledgebase tip #BB373124.

Warning: Before you perform a global delete, we recommend you back up your database.

P

LANNED

G

IF T S

M

IGRATION

T

OOL

49

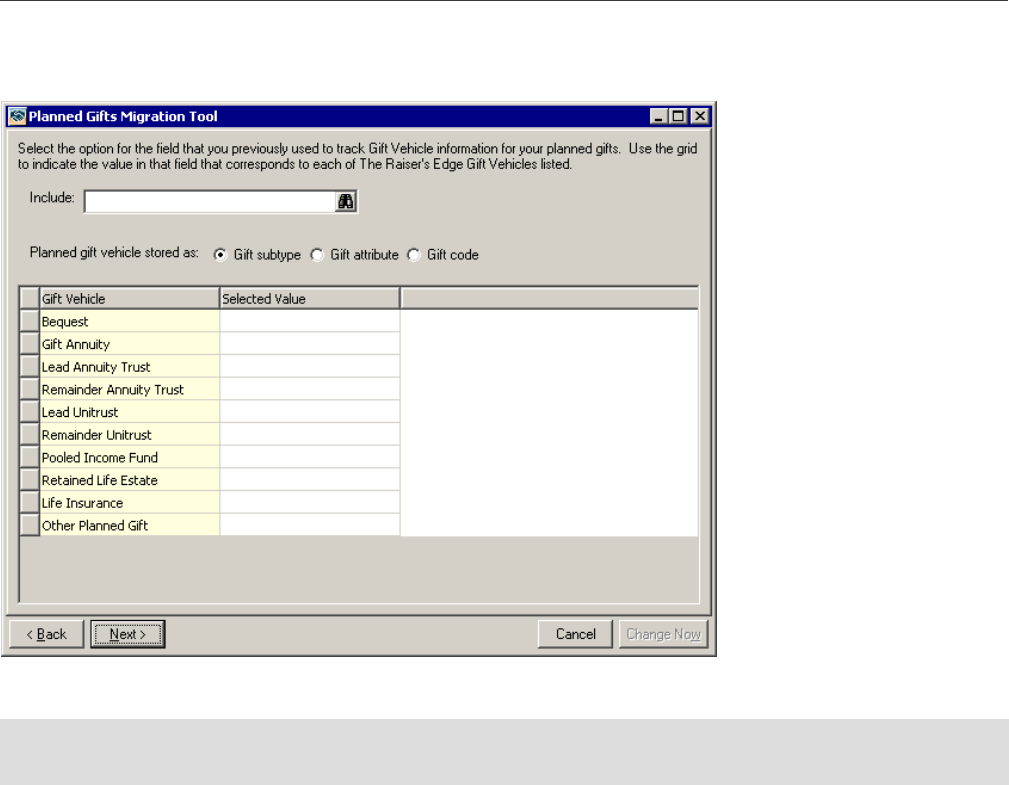

Step 1

In the Include field, select the query of original gift records to convert to planned gift records.

For the migration tool, you must have a gift query. If you have not created a gift query, click the binoculars

button. The Open Query screen appears. To create a new query, click Add New. For more information about

how to create a query, see the Query & Export Guide.

For the Planned gift vehicle stored as option, select whether you previously stored your planned gifts as a gift

subtype, gift attribute, or gift code.

The fields in the Gift Vehicle column are the planned giving vehicles available in

The Raiser’s Edge

. In the

Selected Value column, select your previously used vehicle types that correspond to

The Raiser’s Edge

gift

vehicles.

If you select Gift attribute, the Category and Description columns appear on the screen. In the Category and

Description columns, select the gift attribute vehicle that corresponds to the

Raiser’s Edge

vehicles in the

Gift Vehicle column.

Note: If you are not ready to migrate your planned giving information, click Cancel on the Planned Gifts

Migration Tool.

50

C

HAPTER

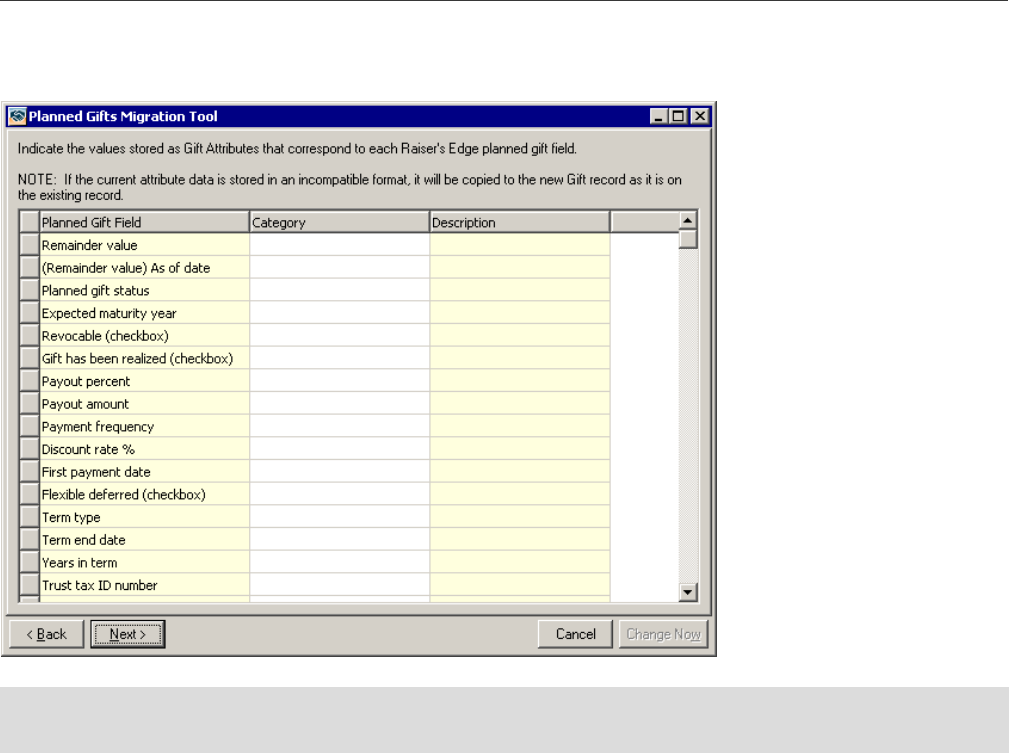

Step 2

The fields in the Planned Gift Field column are new fields in

The Raiser’s Edge

for planned gifts. In the

Category and Description columns, select the gift attribute for planned gifts information that corresponds to

the

Raiser’s Edge

fields in the Planned Gift Field column.

Note: Fuzzy dates do not migrate to a new planned gift record. For example, if you used a gift attribute date of

“11/25” for November 25, this date does not migrate because it does not contain year information.

P

LANNED

G

IF TS

M

IGRATION

T

OOL

51

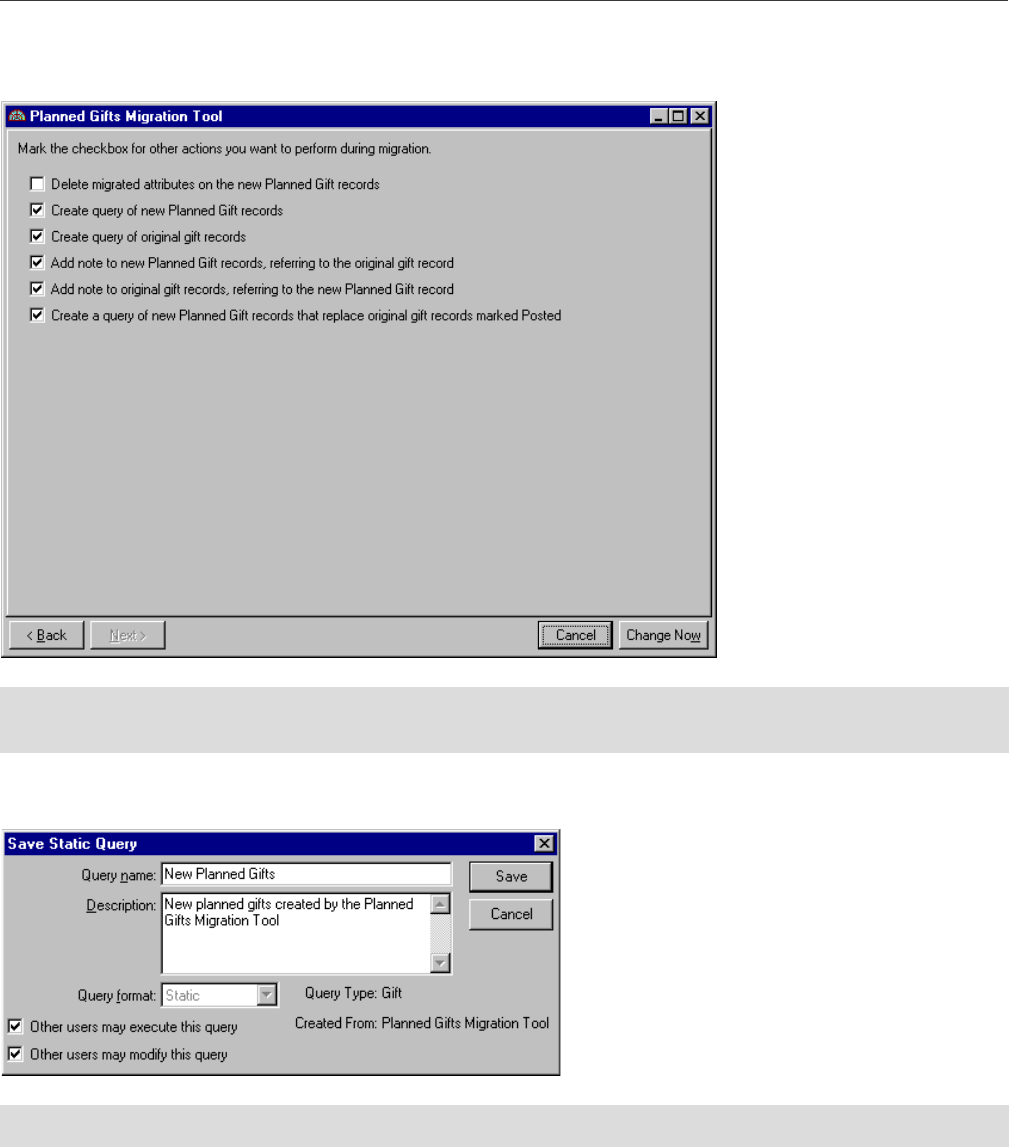

Step 3

Read the checkboxes carefully, and mark the checkbox next to the option to perform during migration.

Click Change Now. If you mark any checkboxes for the query options, the Save Static Query screen appears.

If you want, you can write over the default information in the Query name and Description fields. To limit

othe

r users’ use of the query, unmark Other users may execute this query and Other users may modify this

query

.

Click Save. The migration begins processing.

Once the migration completes, the migration complete message appears. Click OK. The Planned Gifts

Migr

ation Tool closes, and the PlannedGiftMigration.log file appears. Review the log file to determine any

exceptions during your migrat

ion.

Note: If you are not ready to migrate your planned giving information, click Cancel on the Planned Gifts

Migration Tool.

Note: For every query you choose to create, a Save Static Query screen appears.

52

C

HAPTER

Before you perform a global delete of your original gift records, we recommend you back up your database.

For more information about global deletes, see the Global Add, Delete, and Change Guide.

Planned Gifts Migration Tool Exceptions

Because there may be differences between your way of previously storing planned gifts and PlannedGiftTracker

in The Raiser’s Edge, some gifts may not migrate. In some instances, a new planned gift record may be created

but certain data may not migrate. This table includes a list of possible exceptions and exception reasons.

Exception Exception Reason

Unable to migrate gift The gift is not mapped to a Raiser’s Edge gift